Hi, my name is Marin Katusa.

I live over 2,400 miles from Wall Street…

And I don’t have an MBA…

But back in 2003, I discovered an incredible opportunity in the markets… in a small, unique group of stocks.

I was a calculus teacher back then. I didn’t have much money to invest.

But I was so sure of this opportunity, I took out a $180,000 loan on my house… and invested it all.

It paid off. Big time…

Over the next two years, this little sector of the market skyrocketed over 500%. One of my positions climbed from 25 cents to over $6 per share—a 2,300% gain...

It was a big, real money bet that made me my first million dollars.

At first, you might just think I just got lucky. But the amazing thing is, I’ve done this over and over again in my life, for the last 15 years… on some of the best little-known “venture” opportunities in North America.

And right now, I’d like to share my secret with you… so you can take advantage of these opportunities, starting as soon as tomorrow morning.

Like how I made my second million on another tiny group of stocks, after they soared between 600% and 1,000%...

Or how I made a 1,400% gain—including a double in two months—on the same type of venture stocks just a few years later.

This isn’t investing as you’d normally think of it… like buying big, safe blue-chips, or investing for income.

In fact, what I’m doing with my money isn’t for everyone… and there’s a chance it may not be for you.

But I love this kind of investing—and it’s definitely something I’m good at—buying small, little-known companies BEFORE they get discovered… making early investors a small fortune.

For example…

I invested in a small, brand-new venture in a market that was so bad at the time, people told me I was crazy…

But this little company went on to make 1,050% gains in 30 months…

Or in 2008, in the depths of the financial crisis…

I was offered the chance to buy into another one of these new ventures for just 56 cents a share…

And when the company was later taken over by a Brazilian billionaire, I cashed out for a 1,250% gain… and used the profits to renovate my vacation home in Europe.

In short, investing this way—over and over again—has allowed me, a former calculus teacher, to become a multi-millionaire… with a life today that I never could have dreamed of.

These incredible opportunities are typically off-limits to regular investors…

Because they are so small, and so little-known and so unusual, the average investor would never hear about them… until the big gains have already been made.

And unless you know the right people, you’ll never hear about the best of these ventures—until it’s way too late.

Frankly, I don’t think that’s fair.

That’s why, over the past fifteen years, I’ve developed my own unique way of making money in the investment world. You won’t find my approach in any textbook… or on any websites.

When I tell people my secret approach to investing in these types of enterprises, they usually don’t believe me.

But for me personally, it’s created dozens of opportunities in my life.

For example, I’ve sat on the board of a public company… arranged over $1 billion in financings for various new venture companies… traveled over a million air miles to visit companies in more than 100 countries… been featured in The Wall Street Journal, The New York Times, and Bloomberg as well as on CNBC… and even written a New York Times bestselling book.

Along the way – I’ve been approached thousands of times by hedge funds… Wall Street bankers… entrepreneurs… politicians… you name it.

They all want to know the same thing:

How has a guy like me with no MBA… no formal investing education… and no office on Wall Street managed to make millions of dollars in some of the best opportunities of the past fifteen years?

Well, that’s why I’m going to show you exactly what I’m doing, and why it could make you $1,000s a month—or much more…

In short, what you’re about to see is one of the biggest financial secrets in the world.

It requires no meetings on Wall Street… no phone calls… no e-mails.

All you need is a computer and an internet connection. It doesn’t matter what your age or education is – or how much money you have. You can use this secret from your kitchen table in about 15 minutes a week, starting as soon as tomorrow morning.

Let me give you the full story…

More Important than Apple,

Amazon, and Bitcoin

First off, it’s important that you know the difference between conventional investing and what I call “venture” investing.

These days, popular high-tech companies like Facebook, Apple, and Amazon get most of the attention…

But our society is built on a “low-tech” foundation of steel, coal, concrete, copper, lumber, and aluminum…

Our cars, trucks, and airplanes consume millions of barrels of oil every day…

And of course, the oldest form of money—and still far superior to high-tech cryptocurrencies like Bitcoin—is gold.

Our world’s constant demand for raw materials ensures that natural resources will always offer some of the biggest and most lucrative investment opportunities in the markets…

And that’s why I focus exclusively on “ventures” in the world of commodities and natural resources.

For example, earlier I told you about how I took out a loan on my house while I was a professor…

Well, the small group of stocks that turned my $180,000 loan into $1 million were in tungsten—a metal used in everything from light bulbs, golf clubs, and ice skates… to cars, planes, and even cell phones.

I also told you how I made gains of 600% to 1,400% on another tiny group of stocks… in uranium, which of course is used for nuclear power, as well as in colored glass and yacht keels.

In fact, since I started my investment career more than 15 years ago, I’ve seen huge returns in just about every natural resource sector there is…

Including 1,450% in gold…

1,050% in copper…

2,440% in lithium…

Even 4,160% in vanadium, a metal used in jet engines, dental implants, and electric batteries.

Bottom line: Venture investing—done the right way—can make you exponentially more money than conventional investing.

The only way stocks like Apple, Amazon, and Facebook could even come close to making you those kinds of gains is if you got in 10 or 15 years ago…

If you own big blue-chip income stocks, good luck making 2%-3% a year…

And with cryptocurrencies like Bitcoin, sure, they’ve gone up hundreds of percent in one day—but they’ve also plummeted 50% overnight.

I don’t know about you… but would you rather own a volatile cryptocurrency that can be hacked and stolen… and is still unproven to the general public…

Or a real, tangible asset that the world cannot live without—and that has the potential to make you 2 times… 3 times… even 5 or 10 times your money?

But here’s the problem…

Without the right approach, most people will never make money on new natural resource ventures – including you.

And that’s for one reason…

In short, for most people—there’s simply no way of knowing which of these small companies will take off and be successful.

And that’s why I’ve uncovered a huge secret I’ll share with you here today…

A secret that can help you make the exact same kinds of gains I’ve made, on a percentage basis…

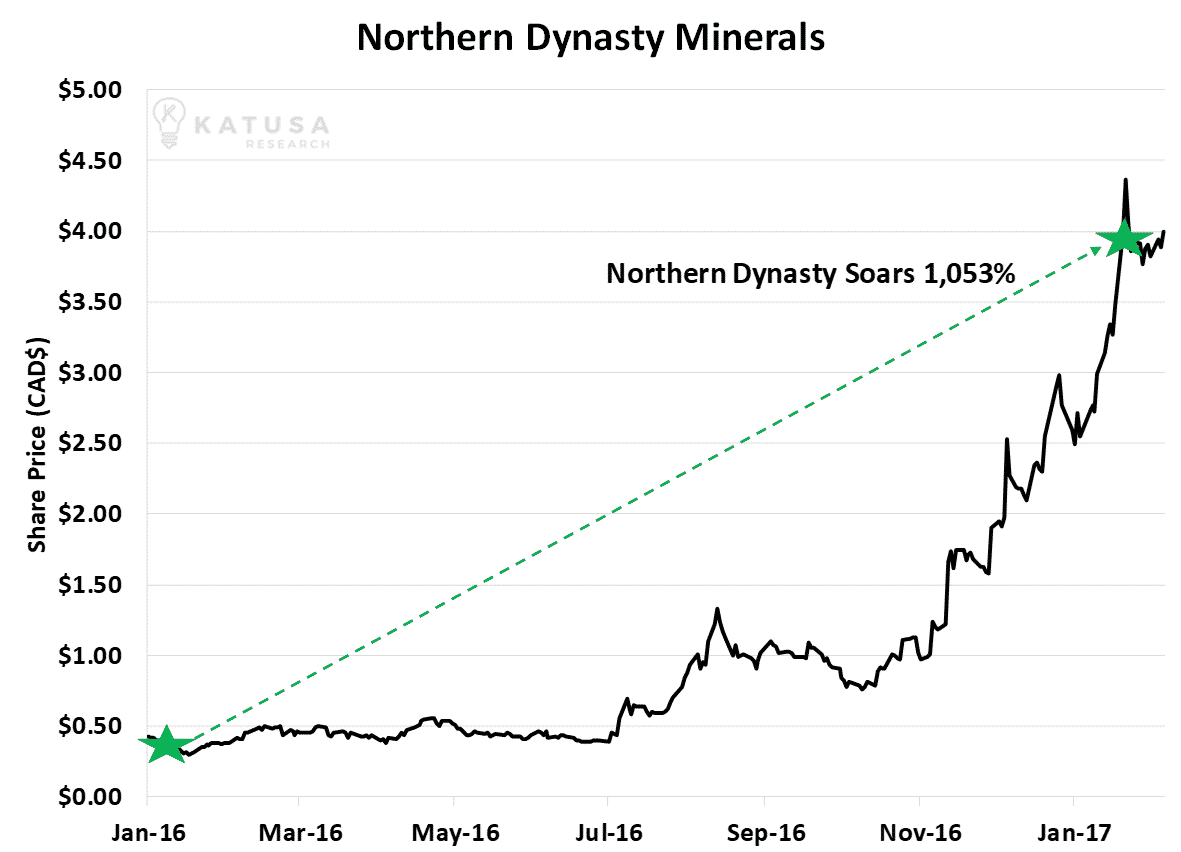

1,053% in 12 months

on Northern Dynasty

On the morning of January 24, 2016…

I stood before a packed investment conference.

I urged people to buy shares in a tiny venture company… one that controlled the world’s largest undeveloped gold and copper deposit in Alaska.

At the time, this tiny venture company was virtually unknown… trading for around 34 cents per share.

Just 12 months later, that same company—Northern Dynasty—became the biggest story in mining, and a huge media phenomenon…

Its shares skyrocketed to $3.92… for a 1,053% gain.

Northern Dynasty became a sensational story because it owns the world’s biggest undeveloped gold deposit…

And also because many believed Donald Trump would support its development in the name of American prosperity.

Every $10,000 invested into Northern Dynasty when I recommended the stock grew to as much as $115,290, in under a year.

No, it wasn’t random luck. Far from it…

You see, most people know that commodity markets run in cycles.

For example, when there’s a limited supply of oil, the price tends to go up… and you can make a lot of money on the “upswing”—like when oil shot up to over $100 a barrel a few years ago.

More recently, the world has been awash in oil. It crashed to under $40 a barrel… and has basically stayed around that level for the last couple of years.

In other words, you can lose a lot of money when the cycle swings back down…

But I’ve been consistently successful in finding the biggest potential gains in this market—no matter what the natural resource markets are doing—

because finding the best investment ideas in this space requires something much more than knowing commodity cycles…

In fact, it’s all thanks to the secret I’m going to show you.

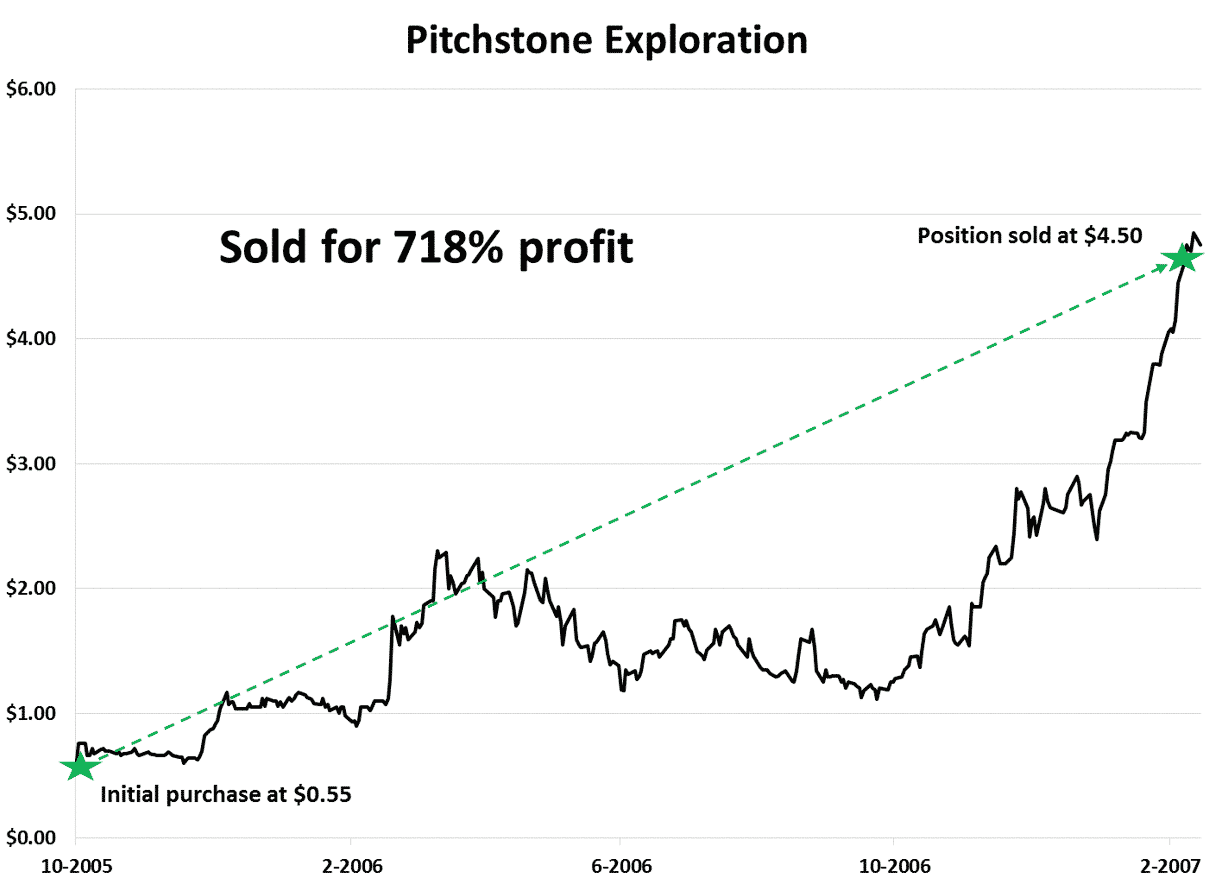

It’s how I made 718% on Pitchstone Exploration, a tiny uranium company…

1,050% on Copper Mountain…

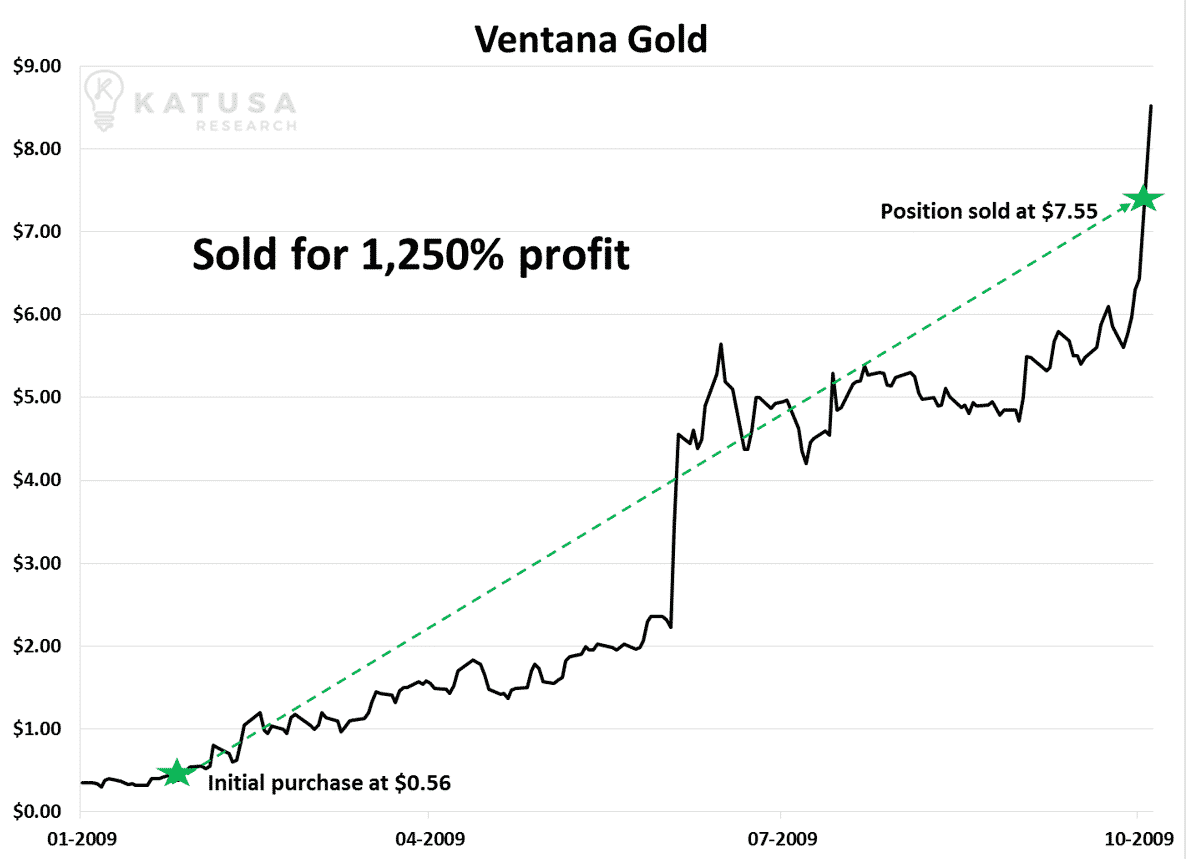

1,250% on Ventana Gold…

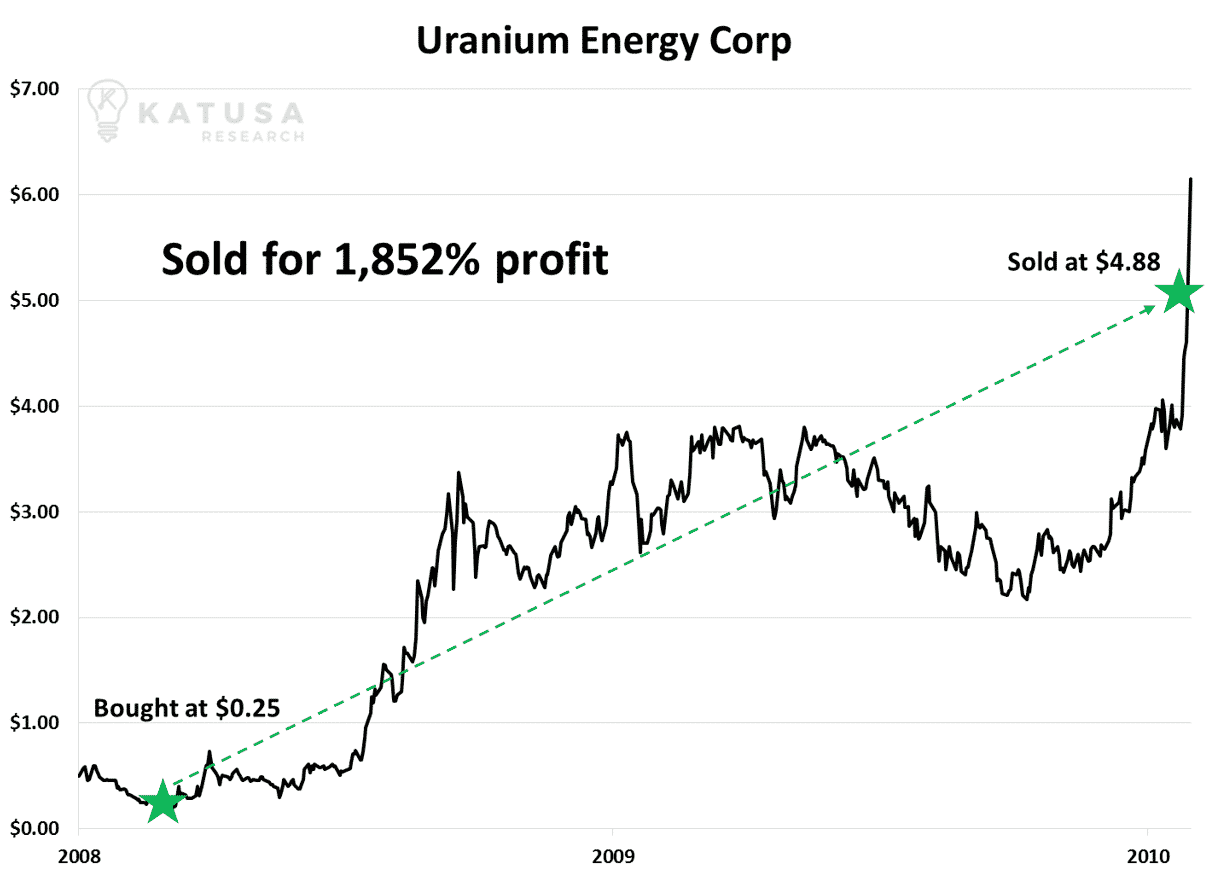

And 1,852% on Uranium Energy Corp… among many, many other big winners…

The Secret to

Making 1,000%+ Gains

How do I find these investments?

It starts with my relationships and contacts.

You see, in this kind of investing, who you know is just as important as what you know.

You can’t just sit behind a computer and uncover the biggest natural resource investments…

Because the kinds of venture companies I buy and sell typically don’t have conventional earnings that most investors want to see.

In fact, some of the companies I buy don’t make any profit at all.

They simply find and develop billion-dollar assets… like oil fields and gold mines.

This is why “cookie cutter” approaches used by thousands of mutual funds and newsletter writers DON’T WORK in natural resources.

My secret is simple:

You have to know the players involved…

And you have to do a lot of legwork… including “boots on the ground.”

For example, I spend long hours in my office in downtown Vancouver, the heart of global resource finance, poring over data…

I hear hundreds of “deal pitches” every year…

I network constantly with some of the world’s most influential CEOs and financiers…

And in the last decade, I’ve flown over one million miles to visit hundreds of resource projects in person.

It’s a lot of work… but absolutely necessary for putting together the kind of track record I have.

That’s exactly what I did with Northern Dynasty, which went up 1,053% in just 11 months…

I knew the key players personally…

I visited the mine in person…

And I spent long hours studying the geology… talking to my many contacts in the mining industry…

Vetting the whole opportunity top-to-bottom so I could stand in front of a packed investment conference and confidently recommend it.

Anyone who heard my advice that day could have made a small fortune…

And that’s the kind of work you MUST do to be successful with venture investing.

For example, one good friend of mine is the founder and Chairman of a very successful global mining company…

He made over $200,000 on one of my recommendations that was a 1,000%+ winner.

Another friend is a well-known author and speaker (I can’t mention his name, but you would almost certainly recognize him)…

He made $600,000—more than six times his money—on a single venture deal I shared with him…

So I can tell you from personal experience:

Unless you’re a real “insider” in the natural resource business—and know the key people personally—it’s unlikely you’ll ever hear about these kinds of small venture stocks… until it’s far too late.

That’s why I’ve taken some extreme steps in my career…

How to Get in Early

on Massive Winners

Early in my career, I did something most people would never do.

I made it a point to meet all the most important investors and entrepreneurs in the resource space.

People like…

Ross Beaty

The billionaire executive behind Pan American Silver, one of the world’s largest silver companies.

Doug Casey

The New York Times best-selling author and one of the world’s best resource investors.

Rick Rule

Legendary resource investor and president of Sprott US Holdings. One of the most important mining financiers in the world.

Lukas Lundin

Chairman of Lundin Mining, one of the world’s best mining companies.

Nolan Watson

Former CFO of Silver Wheaton, one of the world’s premier silver companies. Current CEO of Sandstorm Gold.

Eric Sprott

Billionaire investor and founder of Sprott Asset Management.

Robert Quartermain

Former president of Silver Standard, one of the world’s largest silver companies: Current president of Pretium Resources.

Keith Hill

CEO of Africa Oil, which made one of the world’s largest onshore oil discoveries of the past decade.

Dr. Mark O’Dea

Former CEO of Fronteer Gold, which grew from a $2 million start up to a firm that was purchased for $2.3 billion.

Robert Friedland

Founder of Ivanhoe Mines Ltd. and legendary mining entrepreneur who has made over a $1 billion.

And dozens more…

How did I meet all these people?

Usually, I just picked up the phone or walked into their office. Or I knew someone who could introduce me.

Often, I would simply share my research and investment ideas with them, asking for nothing in return.

That’s how I met and got to know virtually every important investor, geologist, analyst, and executive in resource sector.

That might not sound like a big deal to you… but frankly, I don’t know of anyone else who has the types of connections I have in the venture world.

Like my good friend Doug Casey, Chairman of Casey Research, who says:

Marin Katusa is a genius… the best stock picker in the natural resource field, ever.”

Or my colleague Nolan Watson, President & CEO of Sandstorm Gold:

Marin Katusa is a savvy investor. His excellent past returns speak for themselves.”

And another good friend and contact, Garth Braun, President & CEO of Blackbird Energy:

As an investor in my company, Marin became so knowledgeable about our business and projects that he became a valued advisor to me. You can’t say that about many large investors. Marin recognizes value and he’s very challenging to company management, in a good way. He pushes very hard to make things better for shareholders.”

In other words: I went from being an ordinary teacher… to being “in the room” with some of the best natural resource minds in the country.

But you know what?

Having “friends in high places” is meaningless if you don’t help people make money.

And that’s what I do best of all.

For example…

718% on

Pitchstone Exploration

In 2004, I met a geologist named Ted Trueman. The introduction came through his niece’s husband, who was part of an angel venture investing group I was a member of in Vancouver.

After just a few hours of talking with Ted, I could tell he was the real deal.

Ted is one of the most respected uranium geologists in the world. He had formed a new company that had some promising uranium projects.

I wrote the first research on Ted’s company, Pitchstone Exploration.

At the time, the stock was trading for 55 cents per share. Within three years, it soared to $4.50 per share—a 718% win…

4,160% Gains in

Prophecy Resources

The Prophecy Resources headquarters were located on the 20th floor of a bank building in Ulaanbaatar, Mongolia (talk about off the beaten path!).

But thanks to my contacts in the industry, I got the full details about its assets and future earning power… something that few people outside of the company knew about.

I relayed this opportunity to my clients who saw 4,160% gains.

That type of gain turns every $10,000 invested into more than $400,000…

2,440% Gains in

Lithium One

I had a big score with Lithium One because of my relationships…

Lithium is a vital metal used in things like batteries and ceramics. Now that battery-intensive products like electric cars are all the rage, investors are clamoring for lithium stocks.

This small company started out as the brainchild of mining entrepreneur Paul Matysek, as well as some of the top investment bankers in the business.

We all met one afternoon at Paul’s house. They asked me to compile data on every lithium projects in the world.

(They were blown away by the level of detail I showed them later… especially since I wasn’t a company insider.)

In fact, they were so impressed with my research on the sector that they offered to make me president of the company.

I politely declined… instead, I became a large shareholder.

My clients ended up seeing 2,440% gains on that one…

940% Gains in

GNG Resources

I met the GNG Resources management team on a site tour…

In Canada’s Yukon Territory—where the average winter temperature is -22 degrees below zero.

We were supposed to fly to visit a project, but our plane was frozen…

So I had to help de-ice the plane and push it onto the airstrip so we could make the site tour.

After that unusual experience, the company president started reading my research… because he saw firsthand the lengths I would go to investigate a story.

Thanks to that connection, I later helped finance his next company—and made over 900% on that deal…

In short—I work incredibly hard to nurture and build this network of contacts, because it’s how I hear about the best ideas.

Maybe you’re still thinking that extraordinary results like these are the product of connections alone... and a little bit of luck.

But knowing the right people is only the first part of my successful three-part approach to the venture market…

Massive Analytical Firepower

My lifelong interest in math lead me to become a teacher, and eventually, into the world of natural resource investing.

That’s why, over the past fifteen years, I have developed a one-of-a-kind analytical computer engine that gives me an unfair advantage over other people in this business.

I started working on it while I was a calculus teacher…

It’s the culmination of years of studying math, balance sheets, and asset values.

My team and I spent over $100,000 to build an engine that can analyze and compare hundreds of investment variables. It can calculate any metric or value I need, including many variables that I created myself.

For example…

If I wanted to find a gold company in Canada that has more than 2 million ounces of gold… a market cap of less than $1 billion… more than $10 million in cash… and less than $200 million in debt… my program will pull up every publicly traded company that fits those criteria in seconds.

Hedge fund managers, investment bankers, and securities analysts would kill to have this analytical tool.

It would save them hundreds—even thousands—of hours of research.

This analytical engine doesn’t make actual investment decisions for me, though.

There’s still a huge human element to what I do…

But it helps me “filter the noise” and find big potential winners in the resource sector that few other folks can find. Basically, it does the work of a dozen analysts.

For example, my analytical engine was crucial in helping me find Uranium Energy Corp, one of the big winners I mentioned earlier….

It was trading for 25 cents per share in November 2008.

After doing more research… visiting the mine site… and meeting management numerous times…

Within two months, the stock doubled. After that, it soared to $3.75 a share. That’s a 1,400% return…

The fact is, there are thousands of resource firms in the market.

For most folks, finding the potential big winners is like trying to find a needle in a haystack.

My computer analysis X-rays the entire haystack and finds anything in there I want it to find… down to the precise decimal.

Getting all of the data I need to power my analytical engine is not cheap. I spend over $100,000 on it. But it’s well worth it…

Just ask another friend of mine, who is the CEO of a very successful oil company.

I convinced him to invest in Cuadrilla, a big winner my work uncovered. He made over 600% on his investment…

I also convinced a member of one of America’s richest, most successful oil families to invest in that deal. He made over 600% as well…

There’s one more secret that you must use to find huge winners like the ones I’ve been telling you about…

Over 1,000,000 Air Miles

How many investors do you know who wear a bulletproof vest to work?

Back in 2010, I traveled to Iraq to perform a series of site visits.

After all, the country is home to stupendous oil wealth.

At the time, there was still a lot of fighting going on in the country.

We had to hire guards armed with AK-47s to go with us.

They even had me wear a bulletproof vest in case we drew fire.

I didn’t take any fire in Iraq. But I did perform research that led to a group of folks making 322% gains.

Over the past 15 years, I’ve been all over the world—often to places that many people would never dare to go.

Besides Iraq, I’ve traveled to Kosovo, Kuwait, Russia, China, Argentina, Colombia, Mexico, Kenya, Ethiopia, and dozens of other countries.

In all, I’ve visited more than 100 countries in search of the best and biggest resource investment opportunities.

Some of these trips have me staying in luxury hotels and drinking champagne with VIPs…

But others are the opposite of first class.

For example, in 2007, I flew down to Mexico to investigate a potentially huge natural resource find—an underground cave from the 1800’s…

… where I was attacked by thousands of bats.

I spent the next five days in intensive care… but it was worth it.

The cave later turned out to be home to one of the world’s largest silver deposits…

I urged clients to buy the small venture firm developing it and they saw over 400% gains in 18 months.

Another time, I was snowed in for two days in the mountains in Mexico with no water. But the research I performed there led to a stock recommendation that made investors a more than 10-bagger gain.

Bottom line: Few people are willing to take the risks I do.

But there’s simply no substitute for seeing a project up close, with your own eyes.

That’s why I’ve flown over one million miles to visit hundreds of resource projects over the past 15 years.

The “in the know” people in my network… all the analytical firepower I’ve developed… and my “boots on the ground” research has helped form what I believe is the ultimate resource for making yourself a small fortune in gold, oil, copper, silver, and every other natural resource in the world.

I don’t know of any better way of making a lot of money than the approach I’ve developed over the past 15 years.

But as I said before, it’s more than that…

It’s a very particular secret I’ve developed – a way of analyzing the best venture companies in the world of natural resources… to spot which investments have the highest chance of taking off…

Sharing My Top Ideas

Most people have no idea these venture investments in the natural resources world even exist…

And personally, I don’t think that’s fair.

I wasn’t born wealthy… and I can remember when I didn’t have much money in the bank.

That’s why in recent years, after making all the money I need, I’ve begun sharing my ideas and thoughts in a completely new way… with folks around the world who are sick of hearing about ordinary stocks, mutual funds and 401(k)s… and are ready for something new—and potentially life-changing.

I’ll show you how I made gains like…

1,250% on

Ventana Gold

In 2008, at the depths of the global financial crisis…

A very smart banker named Sam Magid was looking to raise money for a tiny gold company called Ventana Gold.

I knew Sam. I liked him, and I knew he had a history of success. I also knew Ventana owned high quality-gold assets.

I took a large stake in his firm at the price of 56 cents per share.

I also received “warrants,” which are basically stock options that would allow me to profit even more if the stock started to climb.

Eventually, Ventana was taken over by a Brazilian billionaire. I cashed out of the position for a 1,250% gain.

Anyone who followed my lead on this one made a bundle as well…

1,050% on

Copper Mountain

In 2006, I noticed one of the world’s best mining executives had formed a tiny copper mining company.

The executive’s name was Jim O’Rourke. He’s a living legend in the industry.

Because I knew Jim personally and his reputation well, I took a large stake in the company… and told my subscribers at the time about it.

I even went on a nationally televised interview and said the stock could rise by 10-fold.

At the time, the market for copper was so bad that people told me I was crazy…

But the copper market recovered… and the company, called Copper Mountain, soared 1,050% in 30 months after that interview.

Anyone who listened to me made a fortune…

1,852% on

Uranium Energy Corp.

Another one of my big wins came via a friend of mine.

Amir is one of the smartest mining executives in the world. He isn’t well-known now, but I believe he’ll soon be recognized as one of the world’s greatest resource entrepreneurs soon.

In 2008, I analyzed his tiny uranium firm, Uranium Energy Corp. It owned world-class uranium assets… but was extremely undervalued.

I visited the company properties myself. I knew all the major players involved. I knew it had extraordinary potential.

I told folks who were following me at the time to buy the stock at 25 cents.

As confident as I was in my work, Uranium Energy Corp’s performance surprised even me…

Less than three years later, people who followed my recommendation made as much as 1,852% on their investments…

One way I provide the details of how my approach works - and how to begin using it yourself, starting tomorrow, with just a few minutes’ effort at your kitchen table – is through my new book.

It’s called Resource Market Millionaire: How to Invest like an Insider and Make a Fortune in the Natural Resource Market.

If you’re interested, I’d be happy to let you access my new book free of charge, in the next several minutes… to look it over yourself.

Inside, you’ll learn:

- The complete strategy I use in the commodity markets…

- The #1 key to making a lot of money in resource investments, like 1,450% in gold… 1,050% in copper… 2,440% in lithium… 4,160% in vanadium… 718% in uranium… and many, many more…

- How I analyze new ventures, the management, and their projects…

- How much money to place in any given venture investment…

- The simple way to always buy and sell for the biggest potential gains…

- And dozens of other useful secrets that will help you profit from one of the most exciting investment markets in the world.

To my knowledge, there’s no other educational manual on the commodities market like this available anywhere… at any price.

I believe it’s the single best educational manual for natural resources you will ever read.

Again, feel free to look at my book free of charge… and see exactly what I do.

But please, keep in mind: To take full advantage of my approach—it’s critical you have access to a constant stream of the newest ideas in the market… the biggest stories… the least-known trends from the commodity world...

…which for most people is impossible.

The truth is – most “popular” financial ideas are recycled from places like USA Today, Fortune, and the Wall Street Journal… which I can tell you are often worthless (by the time you read about it in the financial media, the big gains have already been made).

Having said that, here’s the good news…

For most of my career, I’ve made a point of sharing my best ideas and recommendations with other people… even total strangers…

- A friend of mine, for example, invested just under $5,000 in one of my top ideas. She made over $150,000 on her investment, which paid for her entire master’s program…

- Years ago, I was having a suit made, and I urged the tailor to get into a stock I knew had extraordinary potential. He later told me he made 10 times his money on the idea…

- Another friend of mine is one of the world’s top commodity fund managers. I urged him to take a positon in a tiny company called East West Petroleum. As the company soared, my friend made over one million dollars in his fund…

- Here’s my favorite story of all: One friend of mine put just $1,000 into a deal that made 10 times her money. She took her parents on a vacation with the proceeds…

You see, part of the reason I’ve developed such a large network of contacts is because I’m not selfish when it comes to sharing great ideas. In fact, sharing ideas is what motivates me and gets me more excited than anything else.

I’ve given away literally hundreds of ideas in my life for nothing.

Most people think I’m crazy when I explain how I do this. But it’s exactly how I made and maintain such a valuable network.

Members of this network have enjoyed some incredible gains.

For example, a fellow named Frank F. wrote to say about my ideas:

Marin always finds investments I have never heard of, but I’ve learned to pay attention. He suggested buying Brazil Resources… I made exactly half a million dollars after getting back my original $90,000. I made over 500% in less than a year.”

Nick F, a dentist and accredited investor, said:

My portfolio has taken off completely. Marin has made a fantastic difference with my success in the resource sector.”

And Ron T., an accredited investor and former pilot, said:

Nobody out there understands what's going on in the resource sector more than Marin does. Aside from his absolute knowledge of what's going on, and his overall business acumen, his value to people like me as an investor cannot be overstated.”

And I love this one. Dave Z. wrote to say:

Marin,

I spoke to my family yesterday about how I felt about devoting most of my life to figuring out the energy space and how to play it and how I don't need to do that because you gave us a huge shortcut by giving us access to the best ideas and companies in the stock market.

While I will continue to educate myself, I feel like we have a huge advantage. I just wanted to tell you I appreciate what you are doing for me; for the first time in my life my trading account is in the 7 figures, and you have a lot to do with that.

What I’m Doing with My Own Money Now

Frankly, I love sharing my ideas… whether it’s on TV, in print or via e-mail…

That’s pretty much how I’ve gotten to where I am today.

In short—I’ve decided to publish my best investment ideas and recommendations and distribute them to anyone who’s interested, no matter what your experience, wealth, or background.

I call it Katusa’s Resource Opportunities.

Throughout the year, I’ll share new investment opportunities in the stocks I’m personally buying—stocks that have the potential to soar 200%... 500%.... even 1,000%+.

And I’ll send you the full details, including how I discovered the idea and the easiest and best way for you to get in on it.

Remember: The kind of venture ideas you’ll receive are the exact same ones that have generated millions of dollars in profit for me…

As well as my friends, family, and just about everybody else I know…

Because I’m passionate about sharing the gains I’m making myself with others.

My point is, scouring the world for great business and investment opportunities, and sharing them with a group of like-minded folks is what I love to do.

That’s why I’ve flown over a million miles to visit over 500 resource projects around the world…

Why I’ve invested tens of millions of dollars…

Why I have billionaires, top fund managers, entrepreneurs, and geologists in my network of friends and clients…

Why I have contacts at the highest levels of government…

And why I know every project and deposit worth knowing about.

Katusa’s Resource Opportunities will give you the knowledge and research you need to take advantage of these spectacular opportunities.

Our coverage universe includes:

- Energy: Oil, natural gas, uranium, oil, coal, solar, wind, hydro, geothermal, and other sources…

- Base metals: Copper, nickel, zinc, lead, iron ore…

- Precious metals: Gold, silver, platinum, palladium…

- Construction: Gravel, cement, crushed rock, sand…

- Agriculture: Corn, soybeans, wheat, rice, coffee, cotton, sugar, timberland, fertilizer, livestock…

- Strategic minerals: Graphite, lithium, magnesium, rare earth elements…

- Infrastructure: Pipelines, storage facilities, shipping terminals…

- “Picks and shovels”: Equipment makers, oil drillers, infrastructure builders…

In short…

If it’s an incredible new venture opportunity in the extraction, transportation, storage, or refinement of natural resources—and gives you the chance at 200%... 500%... even 1,000% gains—you’ll read about it in Katusa’s Resource Opportunities.

But before I go on…

Keep in Mind:

Unlike many people in the financial research business, I put millions of dollars of my own money on the line when I find these opportunities.

This is actually very unusual in the industry.

Many supposed financial “experts” are basically just journalists… with no real expertise, and no money of their own on the line.

That’s not how I operate at all.

I see my research as sort of an “investment journal” of what I’m personally doing… and how it can benefit my friends and clients.

Believe me, it would be no problem to keep this research for myself and a tight group of investors, contacts, and friends…

But like I said, I love helping individual investors make the big gains usually enjoyed by the best investment managers in this business.

That said, there’s something you should keep in mind.

In short: The ideas and opportunities I’ll be recommending in Katusa’s Resource Opportunities won’t be right for everyone.

And that’s for one simple reason: You won’t find any blue chip stocks or conservative bond investments.

To make truly huge returns in the resource market, you must be willing to take advantage of opportunities that lie outside the comfort zone of most investors.

Grabbing the opportunity to make hundreds of percent gains often requires taking a risk…

…which often means buying stocks with very small market caps… the kind you’ll never see or hear in the mainstream news, or mentioned by a financial advisor.

You see, what I’ve discovered after meeting thousands of investors over the years is that many folks can’t stomach these kinds of “venture ideas.”

They can’t execute the discipline needed to buy at or below the price I recommend… or they can’t grasp the fact that you’ll inevitably have a few ideas that don’t work out.

Also—and this is important—you must also be willing to “stalk” these stocks for weeks or months, and wait for an extraordinary buying opportunity.

What I mean is, you’ll be able to act on many of my recommendations immediately. But some of the recommendations I make are “watch list” stocks.

The price you pay to buy my recommendations is very important—if you pay too much, you won’t see the biggest possible gains… and you could end up on the wrong side of the trade.

And lastly, you should have at least $15,000 in capital in order to get started.

It’s none of my business how much you invest in my recommendations. But people who are equipped to use this service typically have accumulated some capital and experience.

If you hope to make a lot of money with my approach, you need to be open to new ideas… you need to be disciplined... and you need to accept the fact that not every idea is going to work out.

Small losses are part of the game. And they’ll be more than offset by the potential 500% to 1,000% gain (or higher) you could make by getting into a truly big idea BEFORE everyone else. It’s happened to me hundreds of times in my life, and I’ll continue to find these opportunities year after year.

Every great investor knows this. The secret to making big money in the venture world is to have an “iron stomach.”

You invest a small part of your total portfolio for the opportunity to make the biggest possible gains... over and over again.

That’s how you get rich with investing.

So if you can’t handle volatile stocks… or investing in small venture ideas that nobody’s heard of yet… please set this aside.

Otherwise, get ready for the biggest, most lucrative investment ideas in the market… which I’ll be choosing for you all year long.

I’ve found that the money you can make from just one or two massive resource winners could be enough to buy a new house… or put a kid through college.

But by now of course, you’re probably wondering…

Better Than a Hedge Fund

How much does it cost to receive Katusa’s Resource Opportunities?

Well, it’s not cheap.

I’m charging a higher-than-usual price, for two reasons.

- This research is extremely expensive to produce.

As you’ll see, what I do is far above and beyond what you’ll see from other research firms.

For starters, I spend over $100,000 per year on data services alone. I travel constantly. I have a five-person full-time staff. When I need specialized insight on projects, I pay for expensive experts.

All of this produces a much, much higher quality research product than you’ll find anywhere else.

- Because I focus on very small, often thinly traded companies with the potential for massive gains, a high price tag keeps the group small, and ensures tons of people aren’t competing for shares.

Keeping the price high is the only way I know of to ensure the information stays valuable for serious investors.

My point is, I think anyone should have a chance to hear about the kind of publicly traded opportunities I’ll be sharing each month—no matter their net worth.

But on the other hand, I don’t want to attract complete “amateurs”… or folks who simply can’t afford to speculate on small venture stocks.

Top hedge funds happily pay $50,000 for “deep” research projects on opportunities like those my team and I create.

Still, what I’m charging is a bargain in the grand scheme of things.

If you invested $100,000 with a hedge fund and it had a big performance year… say a 50% gain… you’d typically pay at least $10,000 in fees.

Having said that, here’s the good news…

We’re not charging anywhere near that much.

The goal of my research is to give you the same advantages you’d receive from the hedge fund and venture resource world… but with none of the outrageous fees.

The reality is, I think my Resource Opportunities offers a lot more than a hedge fund.

For one thing, I’ll be sharing ideas with full liquidity. That means you can trade in and out of these investments anytime you want—unlike in a hedge fund… which can lock up your money for months at a time.

Plus, I’ll tell you exactly how I found and investigated the idea… unlike hedge funds, which often hide their best strategies from the public.

For a small fraction of what people have paid in the past for my ideas (as much as $25,000)… and the kind of gains I’m confident this research will deliver, you’ll get full access to my best resource recommendations for the next 12 months.

One full year of Katusa’s Resource Opportunities costs $3,495.

Frankly, this research is worth ten times that amount. It’s taken me almost two decades and tens of thousands of hours to build up my network and perfect my investment secret.

To do this on your own, it would easily cost you several million dollars and many years of your time.

Not to mention, the ideas I’ll be sharing will have incredible potential. That’s why many of the world’s richest, most successful people follow my work closely.

As I’ll show you, this is an incredible bargain… especially considering that my next winning recommendation could pay for the subscription fee many times over.

Consider: A stake of $5,000 turns into $75,000 on a 1,400% winner like Ryan Gold.

Bottom line: I’ve built an incredible analytical engine that allows me to find the world’s best investments. And I’ve built a network of CEOs, bankers, and geologists that most people only ever read about.

In Katusa’s Resource Opportunities, I’ll be sharing my best ideas for a tiny fraction of what it would cost to join a hedge fund, or what most people pay a financial advisor.

But if you’re interested in joining, I encourage you to act now. I reserve the right to close this offer at any time if too many people respond…so bear in mind that you may never see the price this low again.

So if you’re interested, I urge you to sign up today…

What You’ll Receive Today

As a new member of Katusa’s Resource Opportunities…

You’ll receive a new recommendation from me once a month via e-mail, for one full year (12 issues)… with the full details on what I’m recommending, and how much I expect you could make.

Like the investments I’ve recommended throughout my career, you’ll have the opportunity to make 100%… 500%… even 1,000% gains, in venture companies like I’ve recommended in the past, including…

- 1,920%VMS Ventures

- 1,901%Midas Gold

- 1,650%Lithium One

- 1,480%Primary Metals

- 1,476%Challenger Deep Capital

- 1,450%Ryan Gold

- 1,200%Laramide Resources

- 903%Rare Earth Metals

- 862%Energulf Resources

- 799%Lithic Resources

- 730%Sterling Resources

- 660%Africa Oil

- 656%Salares Lithium

- 777%Stream Oil and Gas

- 620%Caudrilla Resources

- 620%Aben Resources

- 511%Ventana Gold

- 498%North American Tungsten

- 452%on Hathor Exploration

- 420%Reservoir Minerals

- 400%Dauntless Capital

- 376%Bayfield Ventures

- 364%Realm International

- 322%Shamaran Petroleum

- 301%Pan Orient Energy

- 301%Energulf Resources

- 300%Blackpearl Resources

- 300%Contact Exploration

- 266%Blackbird Energy

- 185%Newmarket Gold

- 168%Novus Energy

- 167%Reservoir Capital

- 160%JNR Resources

I’ll look for tiny stocks like these, on the verge of huge moves in oil & gas… gold… uranium… and many other resource sectors.

To make sure you get incredible value out of your subscription, once I decide a stock is a “buy” and at what price, I’ll let you know… and I will wait 48 hours before I buy it myself.

That means you’ll have a two-day head start on the opportunities I find.

I will also alert you when I decide a stock in our portfolio is a “sell”… and in that case, I’ll wait 48 hours before selling the stock myself.

This ensures you are getting the same prices as me…in fact, usually better prices than me – and most important of all, it ensures that there are zero conflicts of interest.

PLUS: When you sign up now, you’ll receive immediate access to my book, Resource Market Millionaire: How to Invest Like an Insider and Make a Fortune in the Natural Resource Market… completely free of charge, with my compliments.

As a member of Katusa’s Resource Opportunities, you’ll also receive urgent e-mail alerts from me any time I spot an opportunity to buy or sell that simply can’t wait days or weeks.

For example, I’m currently researching new investments in the uranium, gold, and oil sectors. I expect we’ll make a lot of money in them very soon…

And of course, you’ll receive a password to our secure website, where you can access the latest issue of Katusa’s Resource Opportunities … my Resource Market Millionaire book… as well as many more educational resources and special reports, just as soon as you sign up.

If you’re not totally satisfied with everything you receive—or if investing in the world’s most promising resource stocks isn’t for you—no problem.

Simply let us know within the first 30 days of your membership, and you’ll receive a full refund, minus a $500 “tire kicker” fee.

(We charge this “tire kicker fee” instead of offering a 100% refund because, unfortunately, some people out there will sign up, access our extremely valuable proprietary research, get all of our best ideas, and then ask for a full refund—basically getting my best ideas for free. I’m not interested in doing business with those people. This way, we keep those people out and attract high-quality members who are interested in long-term relationships.)

Remember—If we have too many folks responding to this offer, I reserve the right to close it down at any time.

So if you’re interested, I urge you to get in now… at a price that may NEVER be this low again.

I think you’ll find it’s more than worth it.

Bottom-line: You can continue investing like everyone else – or you can join me in making potentially life-changing gains of 200%... 500%... 1,000%, or much more…

Just ask one of my readers, James W., who—right after he signed up— wrote to say:

Already paid for itself in one week. Incredible!”

Or Aaron B., who said:

Awesome service… most valuable investment dollars I spend.”

Ronald T. said:

I quickly understood that Marin was perhaps the most intelligent person I was aware of doing work in this sector. I can't think of anybody who has a better command of what's going on, that is more concise with their knowledge and sharing that knowledge, so I am 100% aligned behind Marin in whatever he does.”

And Bill T. wrote to tell me:

With over thirty-five years in the business, I have never seen anyone work so tough, so hard, so diligently and so capably for a guy under forty. Marin is an incredible, hardworking individual, he is relentless in his negotiating skills with companies, and he is a tremendous, loyal person to his subscribers.”

Bottom line: I’ve made a fortune investing this way for the past 15 years…with an approach I’m confident could have a huge impact on your own situation, beginning immediately.

To secure your spot, click the “Subscribe Now” link below.

Sincerely,

Marin Katusa