Dear Reader,

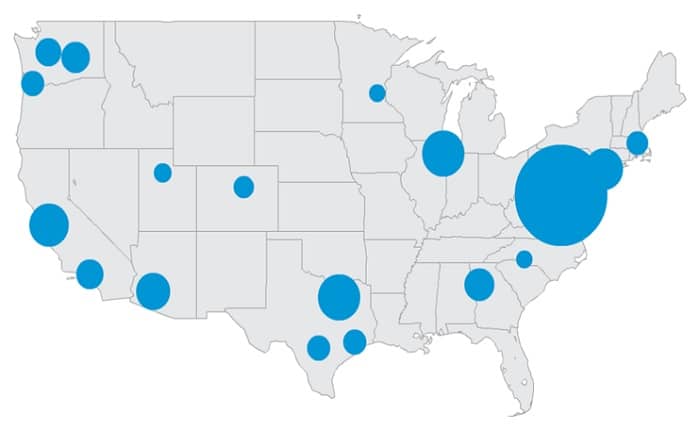

Most people don’t realize that the Department of Defense has quietly built highly secured facilities like this around the United States:

In fact, they’ve built more than 3000 of them…

Each of them has guards on stand-by at all hours…

And they are also equipped with some of the most advanced cybersecurity technology in the world… for reasons I’ll explain shortly.

Here’s the other strange thing: the highest concentration of these nondescript buildings is in a region smaller than Houston, Texas, only 35 miles from the nation’s capital.

The DoD isn’t the only one building these strange facilities.

Nvidia invested $100 million into one…

Apple has plugged $500 million.

Amazon is in for around $1 billion.

Meta has put $800 million.

Then there’s the joint effort between Microsoft and ChatGPT founder Sam Altman – they’re putting more than $100 billion into creating one of these facilities.

And again – the vast majority of these buildings… are being constructed in this tiny region of Virginia – 2,800 miles from Silicon Valley.

You can see here where the concentration of these facilities is:

See, about $20 trillion in global economic activity flows through this area…

Making it a bigger focal point of the tech world than California.

This area of Virginia now bears the distinction of being the single greatest concentration of wealth in America.

260 miles from the famous “Billionaire’s Row” of Manhattan’s Upper East Side.

2,600 miles from the glamor of Beverly Hills.

Wealthier than the new tech “mecca” of Austin, Texas, where Tesla, Apple, Google, Facebook, and Oracle have all opened up offices and headquarters.

Making this area the backbone of the global digital economy.

And it is also the root of what is now being recognized as the A.I. Kill Switch – a single point of failure which could cause the entire revolution of artificial intelligence to come to a screeching halt.

Today, I’m going to show you the side of A.I. the vast majority don’t want to discuss…

It’s a “crisis” that puts not only this technology in peril – but millions of households across the United States.

However, this isn’t a message of doom – on the contrary, I am reaching out today because the A.I. Kill Switch represents perhaps the single greatest investment opportunity I’ve come across in over a decade….

Allowing one company to scream 1,000% or more over the next 12 months.

Understand – this is already underway.

Elon Musk called the AI Kill Switch “a tremendous demand” – requiring urgent solutions.

The International Energy Agency has said that without dealing with the Kill Switch, we are “vulnerable.”

The director of Critical and Emerging Technology at the U.S. Department of Energy, stated that failure to this Kill Switch would lead to a significant loss in America’s position as a superpower.

A dozen government agencies are involved, including DARPA, the U.S. Department of Energy, the Pentagon, and the NSA.

I’m going to lay out this entire situation for you…

And how the most powerful institutions and investors on the planet are now concentrating their resources.

But we’re going to go above and beyond that.

In the midst of this, the biggest wealth creation opportunity has emerged…

Unless it’s addressed by lawmakers and mega corporations swiftly, AI will flounder.

Today, you’re going to receive the three critical steps of my A.I. Blueprint:

- You could see gains in excess of 1,000% over the next 24 months as one major company saves AI from the Kill Switch…

- You’ll have the unique ability to profit every single time someone types a new request into ChatGPT, or says, “Hey, Siri” – right now, there are more than 10 million ChatGPT searches a day. Siri processes more than 1 billion voice searches each month. I’ll show you how to convert this into a lifetime Toll Booth royalty of income on every search.

- And, third, you’ll have a chance to profit from a special opportunity – by discovering an almost monopolistic ‘landlord’ of AI. Almost nobody realizes this exists – but I’m going to lay it out in full detail for you today – because right now, one firm controls the “housing” for 70% of AI breakthroughs in the world.

My goal is to show you the secret side of this revolution…

Because while 99% of investors are looking for the next Nvidia…

The next “AI” stock that’s going to surge like an Apple, a Microsoft, or any of these mega tech corporations…

The real winners will simply be overlooked, except by those who will make a fortune by owning these positioned companies.

I’m going to show you where the smart money is already pooling their resources…

I’m talking about firms like BlackRock, Vanguard, and Goldman Sachs.

In fact, these companies understand the real power isn’t going to be buying Nvidia or Amazon or Microsoft…

It’s financing the “toll booth” companies which will control the very future of AI…

Without building a single microchip or writing one line of code.

Now, I know this can sound like hot air.

So let me explain a little about who I am – and why I am bringing this to your attention today.

My name is Marin Katusa.

I live over 2,400 miles from Wall Street…

I live in the epicenter of resource finance. In fact, some of the largest resource companies were first financed out of my office with my lead order.

Over the last decade I have raised over $2 Billion for public companies.

I have also written two bestselling books, The Rise of America, and The Colder War, which were about energy and finance.

I have traveled over a million air miles to visit companies in more than 100 countries… been featured in The Wall Street Journal, The New York Times, and Bloomberg as well as on CNBC.

Along the way – I’ve been approached thousands of times by hedge funds… Wall Street bankers… entrepreneurs… politicians… you name it.

Which brings me to the unique situation today…

With the rise of AI… we are witnessing perhaps the single greatest global transformative event in human history.

IBM’s Watson Health AI collaborated with the University of Toronto to create the first new treatment in forty years for a deadly brain tumor in children.

The Breakthrough Starshot Project is projecting to send AI-powered spacecrafts to the Alpha Centauri star system – gathering data on collision avoidance and the interstellar void while traveling at 20% of the speed of light.

But these great technological ambitions have a cost…

And that cost is creating unprecedented strain on outdated systems in North America.

However, it has also set stage for the most lucrative investment opportunity of the decade…

And it doesn’t require you to touch a single speculative microchip stop.

As I’ll show you today, circumventing the “mania trap” is one of the fundamental secrets which has helped me execute more than $2 billion in equity deals…

And allowed me to secure windfalls of 1,050%… 2,300%… even upwards of 4,000%.

I’ll explain more about that shortly…

But suffice to say, the #1 company I want to share with you during today’s presentation has situated themselves for total dominance- with a real time possible gain of 1,000%.

When I highlight the 3 critical steps to take today… I’ll lay it all out in detail.

But for now, it’s important you understand what this situation is… and why it has put the entire AI revolution in jeopardy…

Why it has spurred Billionaires such as Elon Musk, Bill Gates, and Peter Thiel to take immediate action.

And why failing to act could leave 300 million men and women across North America living in a new dark age.

Let me give you a glimpse…

It was 40 degrees below when a former firefighter named Paul LeBlanc saw his neighbor’s house explode into flames.

30 years of training had prepared him – so he dropped the garbage he was taking out that morning, and ran as fast as he could to the house. He smashed the windows, and forced his way in.

The only person home was a teenage boy, who escaped with minor injuries.

But then he heard it again.

And again.

“Fire.”

The alarm rang throughout the neighborhood.

Here is the devastation caused to just one of the homes.

Why am I telling you this?

Because right now, more than 1 million homes are at risk of going up in flames – just like this.

What caused it?

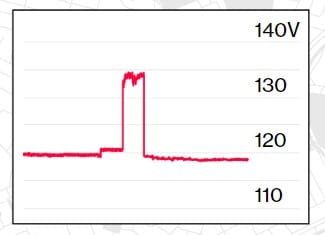

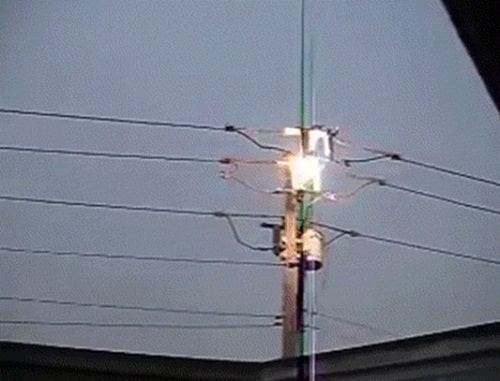

This:

What you’re seeing here is a voltage surge that lasted 86 seconds.

The reason is simple: the U.S. electric grid is beyond outdated. The last major advancement to the electrical grid in the United States was back in the 1970s.

And it’s showing its age.

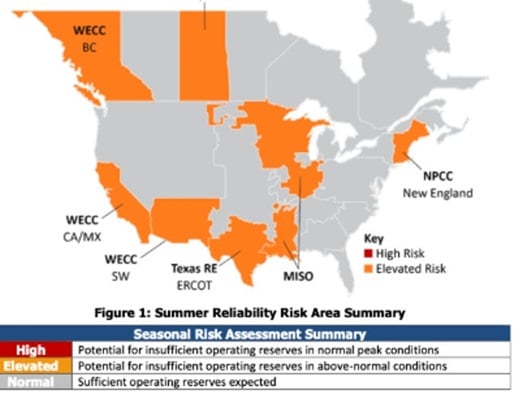

RealClearEnergy wrote, “Electricity Grid In Peril: A National Priority.”

Politico recently published an urgent warning, stating, “Electric grid woes foretell risk of blackouts.”

And the energy organization, SAFE, hammered home the problem when they said, “[The] U.S. Must Address Power Grid Vulnerability.”

Just look at this map of electrical blackouts across the United States and into Canada.

Numbers say this trend is only getting worse – and will impact more than 300 million people over the next 4 years.

We’re talking about the equivalent of nearly the entire population of North America.

I’m sure you’re wondering – what does this have to do with AI?

Everything.

All of this comes back to the unprecedented situation AI has created…

An aging power grid, and an energy starved nation, have to feed the equivalent of an entire new first world country’s hunger for electricity.

Take a look at this headline from Bloomberg Law:

“Blackstone CEO Warns AI Boom Threatens World’s Electricity Grids”

Most people have no idea that AI is going to be the single most energy demanding technology on Earth.

Between crypto and AI, the equivalent of a small country – like Argentina – has already been added to the energy grid in terms of demand.

Let me repeat: in terms of energy demand, a new Argentina has been created by AI and crypto.

Within 2 years, that “Argentina” of electricity demand is expected to grow to a Japan – that’s almost 700% more energy required.

Goldman Sach’s believes that by 2030, if AI and data centers were its own country, the energy demand requirement would make it a Top 10 country worldwide.

Our electrical system is not designed for this kind of demand.

The problem this creates cannot be overstated.

Morning Brew’s recent article on the subject laid it out clearly: “The Power grid has an AI problem.”

The Washington Post hit the bullseye just recently:

The reason for this massive pressure on the energy grid…

Brings us right back to that little area in Virginia – where the top tech titans are building facilities…

Where the Department of Defense has built more than 3,350 strange buildings (millions and millions of swaure feet) under constant surveillance…

These buildings are the AI Kill Switch.

Here’s why:

70% of internet traffic runs through these buildings you see on your screen.

I don’t mean 70% of US internet traffic.

I mean globally.

Everything from google searches about how to cook pasta to a “Hey, Siri” joke filters through these buildings…

And each one of those things that we take for granted every day has a cost of kilowatts.

Every text message, ever meme we forward creates weight on the grid. As an example, 23 billion texts are sent daily, globally.

This comes out to an energy demand of 127 MILLION kilowatt-hours a year.

That’s enough electricity, just in text messages, to power almost 12,000 U.S. households.

It could power 63 skyscrapers for a year.

Now consider what every search query on Google costs…

And most importantly…

Every calculation by the rapidly growing AI algorithms which are becoming more and more pervasive.

Here is a fact most people don’t discuss:

ChatGPT consumes 17,000-times more electricity DAILY than the average U.S. household.

You could power 17,241 households in America for a day just from ChatGPT’s electricity daily consumption consumption.

That’s one AI model.

PwC – one of the Big Four accounting firms – says that 73% of U.S. companies have adopted AI in at least some area of their business… and 85% of executives planning to increase their spending on generative AI.

The demand on our energy grid is only going UP.

And it’s this demand which has also powered some gargantuan wins in the market…

Pushing Nvidia to become one of the largest companies in the world – with share prices rising 1,500%.

But every single one of them relies on what happens in these buildings in this small area of Virginia – now the wealthiest place in America.

You see, these buildings are called data centers.

And these data centers are – for lack of a better term – the brain of AI.

Because just like your brain stores memories… processes ideas… makes decisions…

These data centers are where the vast computers that compute the AI algorithms are… they store and provide the power to enable the vast amounts of computations AI needs to process…

And just like your brain is the highest energy consuming organ in your body…

AI’s need for electricity at these data centers is rapidly growing….

In fact…

“It’ll soon be equivalent to the energy demands of 40 million U.S. homes.”

That’s a conservative estimate by the prestigious Boston Consulting Group.

I want you to pay close attention, because right here I’m going to outline the true peril speeding towards the U.S. electrical grid… but, as others are saying, this is a global phenomenon.

Just this year, the IMF ranked Ireland the 2nd wealthiest country in the world… with a GDP per capita DOUBLE the EU average.

And just like Loudoun Country, Virginia – Ireland is a global leader in data centers.

And just the United States as a whole, Ireland is suffering extreme energy supply swings. The luck of the Irish is running out. Within 2 years, a third of Ireland’s electricity will be eaten up by data centers.

According to the International Energy Administration, data centers consume about 162 billion kilowatt-hours per year. This is equivalent to 15 million households in America.

By 2030, that will increase to 244 billion kilowatt-hours.

That’s equivalent to 23 million American households.

And again – Boston Consulting Group pegs that it higher. They’re expecting us to touch the equivalent of 40 million U.S. households worth of electricity before the end of the decade.

That’s more than the entire population of Scandinavia – Sweden, Finland, Norway, and Denmark…

All used by these facilities across America…

Or put this way: the country of Canada has 40 million people.

These data centers already use double the amount of electricity of 40 million Canadians right now in terms of pure kilowatt hours.

With concentration right there, in an area called Loudoun County, VA.

And again – that total demand of energy is expected to rise to the needs of a Japan – we’re talking about enough electricity to power 125 million homes… or almost equal to all the homes in the United States and 1/3rd of the total population.

Entirely generated by these data centers around the United States – with the central hub right there, about an hour from the nation’s capital.

And they’re building more.

A lot more.

- Microsoft’s Bill Gates and Sam Altman have $100 billion planned for a data center.

- Amazon has plans to invest $10 billion into two data center complexes.

- Meta has $800 million earmarked for an AI optimized center.

- Google has started construction on $1.6 billion worth of data center projects.

And this is just over the next 12 months.

When you couple this with the fact most of the electric grid is extremely outdated… it starts to become a little more worrisome.

In fact, most of the transmission lines in the United States are over 25 years old… and much of the grid itself was built in the 60s and 70s.

In the 1960s, the population of the United States was 179 million.

It has since nearly doubled.

And with the advent of the data center and AI age – we’re talking about adding a Scandinavia… an Argentina… even a Japan of demand strain to the system…

While America is expected to grow its population by another 30 million over the next decade.

The CEO of ARM, who supplies 99% of smartphone chips to Apple as well as the critical CPU needed by Nvidia’s AI chip, expects:

Artificial intelligence will “devour 25% of U.S. electricity” within the next 6 years.

The International Energy Agency says that AI data center power consumption will grow 1,000% from where it was just 2 years ago.

In the Chicago area alone, AI-driven energy demand is expected to jump 900%.

Not to mention the demand on the system by the rise of electric vehicles – which add another 1 trillion kilowatt hours.

And that is only expected to rise.

This is not sustainable – period. And everyone knows it.

It’s why Christian Bruch, the CEO of Siemens Energy, just said, “No power, no AI.”

Now – I want you to understand again… this is a huge, huge opportunity.

This is a chance to mint generational wealth as the world renovates its technologies and energy infrastructure.

The closest comparison I can make is when the covid crisis ignited a situation that floored some of the biggest tech companies in the world…

And sent others through the roof.

I’m talking about the Chip Wars of 2020

When Covid brought the world to a screeching halt in 2020, forcing everyone into “stay at home” and igniting a new, work from home revolution…

It caused an explosion in some critical computing services: web conferencing, online gaming, trading…

All of these things created sharp demand… on chip manufacturing.

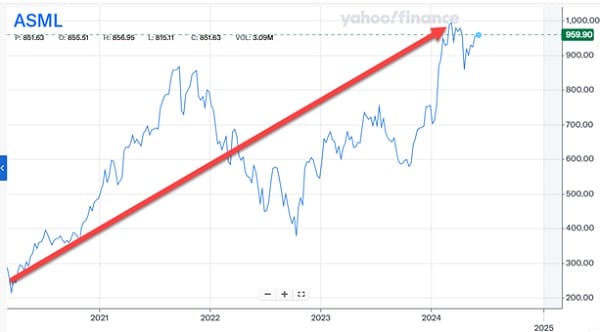

Companies like ASML.

Taiwan Semiconductor.

AMD.

Nvidia.

At the start of 2020, these weren’t well known firms. The stocks were trading for $297… $57… $49… and $58, respectively.

The ability of the existing supply chain infrastructure to meet that demand was completely out of whack.

And of course, the resulting gains seen by these firms are still apparent today.

ASML went from $200 in 2020 to a peak of around $1,000. We’re talking a 500% gain.

Taiwan Semiconductor went on an 300% tear.

And Nvidia is up 1,500% – now one of the largest companies on the planet.

America is in a similar situation right now…

And just like these companies roared higher… the firms that position themselves right now stand to see the lion’s share of profits in the days to come.

Because right now… instead of a bottleneck for microchips needed to operate the technology…

We don’t have the energy to operate any of it.

The AI Revolution Needs a Breakthrough to Survive.

Not only is the need for energy skyrocketing to the point it’s overwhelming the grid…

But it also cannot produce enough with the current systems.

See, this strain on the grid comes from two factors:

- Outdated systems which were built for populations half the size they are now – pre-Internet and Data Centers, which add a nation’s worth of electricity demand

- The war on fossil fuels – which creates massive gaps in energy supply and wild swings in voltage

A major problem with electricity is that it needs a consistent, readily available source of “fuel” to convert.

When these surges cannot be met, it creates abrupt spikes which destabilize the system.

These voltage spikes lead to bursts of power as the system struggles to adequately meet the demand.

It looks like this:

Think about that.

A system for processing electricity which is 50 or 60 years old…

Designed for a pre-internet society, with half the population…

Is now trying to meet demand while also running out of energy.

To quote RealClearMarkets:

“America is running out of power.”

Now, in just a second I’m going to tell you these factors have laid the groundwork for perhaps the best investment of the decade…

One I anticipate will soar as much as 1,000%, based on my two decades of analyzing companies and completing over in over $2 billion worth of financing deals.

I’m even going to dive into the three critical profit steps to take today… steps you just make to fully capitalize on the lucrative opportunity in front of us.

Because you must understand this: AI will not be allowed to fail.

Governments and corporations will go to any lengths necessary to sustain it. Otherwise, they risk falling behind in an arms race with the 2nd most powerful nation in the world – China.

It’s for this reason massive action has been taken.

Coal plants are being revived just to power data centers.

A proposition was put forward in Loudoun Country to build extensive diesel generators to power these facilities. Diesel is literally the MOST EXPENSIVE and high polluting source of electricity that exists. But desperate times will call for desperate actions.

Oil companies like Exxon, Chevron, BP, ConocoPhillips – they’ve posted record profits – buying up drillers left and right to maximize well production… especially squeezing America’s shale oil reserves.

It’s estimated America can run for around 20 years without importing a single drop of oil… just by harnessing our recoverable shale oil reserves.

The result is oil companies posting profits upwards of $600 million per day – some of the highest in history.

Oil is up 400% per barrel over the last 4 years. Forecasts expect it to jump another 50% within the next 12 to 18 months.

President Biden has already had to open the spigot of the U.S. Strategic Petroleum Reserve to temper prices.

They’ve even brought AI into the well drilling process to make it more efficient.

Unfortunately, it still won’t be enough.

It’s already being dubbed “A looming crisis.”

And As The Financial Times said: “Booming AI demand threatens global electricity supply.”

To give you a little more idea of the severity…

Remember that within two years… data centers will consume a full third of Ireland’s electricity.

That’s just one small nation with a handful of data centers.

Consider the USA – where 70% of internet traffic funnels through.

And now while you might be thinking, “Marin – you just said a minute ago how the American shale oil boom could generate decades worth of oil – how is an energy shortage possible?”

For that, I want you to look at this headline from Reuters:

The problem is that AI is the banner of green tech.

And it is perhaps the most climate damaging technology in the world.

MIT Technology Review wrote that its impact on the environment is “staggeringly high.”

Training a single AI model can emit 5x more carbon emission than an American car will in its lifetime.

That’s one model.

Brian Mullins, the CEO of AI company Mind Foundry, said that without addressing the environmental dangers of AI, it could become “the 21st century equivalent of plastic packaging…. A scourge on our planet.”

This is from a guy who works on AI as a career.

Here’s the point: regulatory agencies will simply not allow Big Tech to harness the oil they need to power the AI Revolution.

They’re grandstanding on the need for Net-Zero.

In day’s past, the government might have just installed new pipelines…

Fired up new gas wells…

But this just isn’t the case right now.

In fact, it’s the opposite.

U.S. lawmakers have created a moratorium on drilling and well expansion – effectively hobbling the ability of even the largest oil companies to meet the demand needed to keep the grid supplied with stable energy.

Remember – stable energy is what keeps voltage spikes from blowing up transformers. Not only has new well production and approval fallen 60% since 2020, but pipeline construction has taken a devastating blow…

The rejection of the Atlantic Coast Pipeline, the Dakota Access Pipeline, and Keystone XL over the last few years have forced existing pipeline operators to squeeze every drop they can.

And it wouldn’t matter anyway – the Big tech companies that need the power for their AI data centers have a unique set of obligations: Internationally enforced Environmental, Social, and Governance mandates.

In short, the tech companies pioneering AI and data center construction must remain in compliance, or attempt to be in compliance, with federal laws regarding climate impact and greenhouse gas emissions.

When you consider that by 2026, data centers will create the carbon emission equivalent of 80 million gas-powered cars… you can see the problem these firms are facing.

Things like the Energy Independence Security Act of 2007 – which requires tech companies to produce to certain standards of climate efficiency.

The California Title 20 Appliance Efficiency Regulations.

The Federal Energy Management Program.

And these are just three of the dozens here in the United States alone.

Not to mention that these corporations know they risk losing funding from major investors like Blackrock, Vanguard, and State Street- all of whom require climate policy compliance in order to provide financing.

It’s a rock and a hard place.

- The International Energy Agency published this press release recently: “Global electricity demand is growing faster than renewables.”

- Mckinsey’s projections for hydrogen and other renewables becoming even 50% of the global mix don’t show that happening until 2050.

- To achieve total renewable reliance by 2050’s Net Zero Carb mission, we’d have to install either 995,000 new wind turbines… 881 nuclear plants… or 3.9 million solar panels over the next 27 years.

In our best year, we installed 5,600 wind turbines.

And again energy demand is skyrocketing.

AI will soon more than double in its electricity needs.

Electric Vehicles could add a strain of 1 trillion kilowatt hours to the grid – taking the realistic output to 125% of full capacity. And AI data centers don’t take a break for lunch and dinner, nor do they rest for 8 hours and go to bed. Data centers run full throttle 24 hours a day, 7 days a week, 365 days a year.

Goldman Sachs expects AI will drive a 160% increase in data center power demand.

No matter where you look, the coming storm of AI’s need for power and the supply crunch is unanimous.

But in this mayhem is also the chance at a life-changing windfall.

Just think about this…

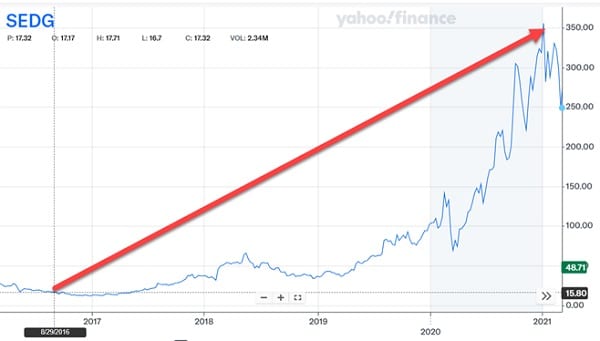

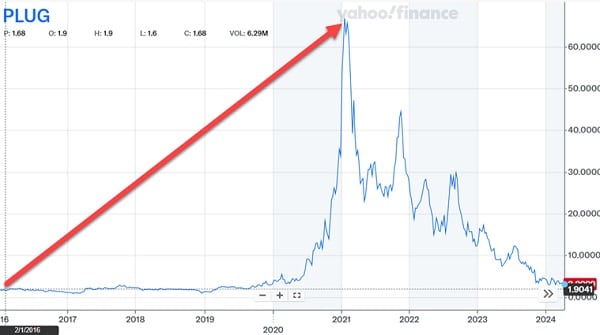

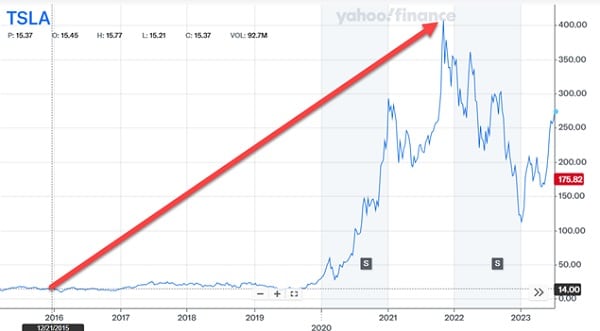

In 2016, when President Obama launched his final efforts in office to push sustainability and clean energy… it sent a battalion of green energy companies skyrocketing.

Enphase Energy roared from under $4 to $180 – a gain of 4,400%.

Any one of these could have produced a fortune – even starting with $5,000.

I say all this so you understand one fundamental point: the energy demand of AI, and its place both in the public and private sector…

Especially with demands by the DoD…

AI failing is not an option.

The AI “Kill Switch” created by these energy hungry data centers cannot be allowed to flip. This means the electricity Electron Rush must continue. The flow of electricity to power the data centers (Electrodollar) is more vital to America’s economy than the Petrodollar.

Otherwise America surrenders its dominant position to nations like China….

Something policymakers are already unwilling to do. It would be a catastrophic mistake for America’s positioning as the #1 global superpower.

And Washington knows it.

They’ve instituted a a 10-year ban on American tech companies operating facilities in China if they want American subsidies…

As well as laws prohibiting the sharing of chip designs with Chinese firms.

The military has all but vowed to destroy the manufacturing plant of Taiwan Semiconductor in the event of a Chinese invasion into Taiwan.

The United States is ready to raise arms to maintain its control of artificial intelligence.

It’s why there are hundreds more data centers in preparation right now…

Why the Department of Defense has launched 600 new AI projects… and submitted its largest budget request EVER to expand the usage of Artificial Intelligence.

It has already started – MIT recently published a paper outlining four ways AI is making the power grid “faster and more resilient” by predicting EV charge times, places with the highest wildfire risk, and more.

They have to do this.

Remember – it’s expected that 25% of America’s electricity will be consumed by AI every year by 2030.

That’s more than 1 trillion kilowatt hours.

Electric Vehicles will continue to strain the system – adding another 1 trillion kilowatt hours.

And right now, the system is already running near its maximum capacity.

This leads me to the three steps I urge you to take, today, to properly position yourself…

Because while this seems like pure chaos – it is a fertile ground for opportunity.

Some of the biggest windfalls of the decade will emerge from this energy-supply/demand constraint.

And I’ve spent the last three years building the perfect blueprint, based on having financed more than $2 billion in deals myself…

Step 1: Invest in the Next Wave of Energy

As the world wakes up to this situation, most people are going to think to pile into oil.

And they’ll probably do fine.

There’s simply no way the price of oil won’t be pushed higher – probably to north of $100 a barrel.

I expect companies like Exxon, Chevron, and many of the “Big Oil” Royals will post record profits over the next few years.

Let me remind you – even Elon Musk has said it would be catastrophic to stop using fossil fuels right now.

But everyone who fixes their eyes on oil is going to miss the real homerun.

Because there is one source of energy which is experiencing a renaissance.

Nuclear.

This is perhaps the cleanest, most abundant source of energy in the world – allowing for seemingly endless, emission-free power.

It’s perhaps the only prayer AI has to sustain itself.

In fact, Sam Altman – the CEO of ChatGPT developer OpenAI – has sought $7 trillion to finance a data center operation powered completely by a nuclear fission focused facility.

Microsoft already has $10 billion in a nuclear bet.

Dow Chemicals has $500 million invested in a nuclear facility.

Constellation Energy has planted $900 MILLION into nuclear projects.

Then, on an individual level…

- Jeff Bezos has put $19.5 million into funding for one company.

- Marc Benioff, the founder of Salesforce, invested in the $1.8 BILLION funding round of Commonwealth Fusion Systems.

- Peter Thiel of Paypal and Palantir has led funding in a nuclear startup called Helion Energy – with total incentives an investment north of $1.7 billion.

- Even Warren Buffet has partnered with Bill Gates on a billion dollar project in Wyoming.

Again – the biggest players are here.

I mentioned earlier how to supply the needs of AI, we would need to build the equivalent of 40 nuclear reactors within the next 5 years.

Equivalent to nearly doubling the number of nuclear plants in America today.

This is basically underway – with numerous advanced reactor projects currently waiting for legislative approval and funding.

The game changer?

The usage of AI in the regulation of nuclear reactors.

In fact, the International Atomic Agency outlined seven ways AI will change nuclear science.

And it’s already pushing nuclear energy companies up.

Constellation Energy Group has doubled in the last year.

NuScale Power Corporation jumped 300% in 3 months.

And Talen Energy is up more than 100% in less than 12 months.

But this is still the very early innings…

Because the real game changer has only just emerged.

Step 2: Collect a Lifetime of Income From Energy

While the biggest gains to be made from the AI Kill Switch situation won’t be in oil…

There is one class of investments in the oil sector which will pay a lifetime of income.

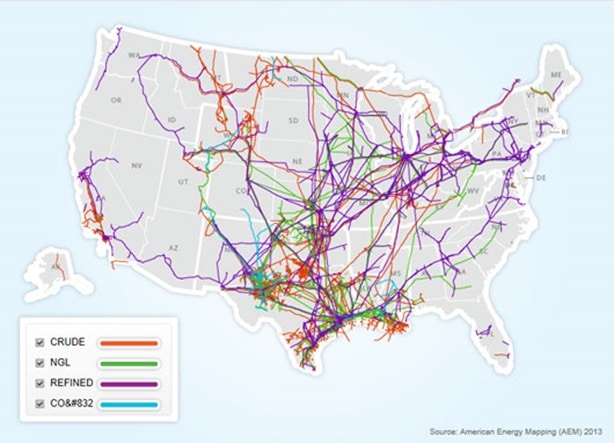

Take a look at this:

What you’re seeing is a map of the pipeline network of the United States.

What you probably don’t know is that a few, powerful groups own all these pipelines…

And they are paid for every drop of oil, natural gas, and natural gas liquid which runs through them.

It doesn’t matter what the price of oil is.

As long as oil needs to be transported, a few companies operate as the toll both.

One of them has become perhaps one of the best, most consistent energy plays of the decade.

Their total return over the last 30 years is 2,000%.

Last year, they transported 30% of the total amount of crude oil produced in North America.

We’re talking over 4 billion barrels per day.

It’s why they’re a king of the energy toll booths… And it shows.

They’ve grown at an annual average rate of 12% – crushing the S&P.

And the best part is…

They pay a skyrocketing dividend.

I’m talking 7-times more than the average dividend stock…

It’s why, from their holdings alone, three of the executives at this company receive an AVERAGE quarterly payout of $258,000.

We’re talking 7 figure payouts – not counting salary.

That’s the abundance of money flowing through this company.

Not only do I expect this company to jump 500% in the next couple of years…

But because of the unique structure of the company, they could start paying you out a significant return within 3 months.

And here’s another bonus – they’re also in the renewable energy game, with 23 wind farms between the US and Canada.

Every single time a demand is put on the power grid…

Every “Hey, Siri” spoken each day…

Leads to this company pumping more oil….

And you get paid for each one of them.

I lay out this company fully in my 2nd special report – The Payday Protocol: A lifetime of income thanks to America’s Pipelines.

Plus, I give you a 2nd stock in this report I think could be just as dynamic…

And then, there’s the third step – perhaps one of the most crucial for the longevity of the AI revolution….

Step 3: Profiting From The Landlords of AI

Most people don’t realize the situation in Loudoun County has minted a new tech dynasty…

And the firms who hold the keys to the future of the AI revolution… aren’t even tech companies themselves.

Yet, one company in particular stands equal to Nvidia… to ARM Holdings… to Taiwan Semiconductor… in its ability to influence the future of artificial intelligence.

In one fell swoop, this company has become the de facto “landlord” of AI – quietly controlling the operation of more than 12 MILLION sq ft of data center space.

Those 12 million sq ft of data center – again – are the hub through which 70% of global internet traffic flows through.

It’s also jeopardized by the dramatic swings in energy demand… leading to power outages and even transformer explosions across the country.

This problem is set to impact 300 million people in North America.

And this one company – the Landlord of AI – is going to reap the king’s ransom by not only orchestrating the correction of the problem…

But requiring all these data centers, and therefore all these AI giants, abide by their rules.

To say this is a loaded situation isn’t doing it justice…

BlackRock, Vanguard, and State Street all know it – and have taken huge stakes in the AI Landlord.

Which is why I’ve put the full details in a third report, The Landlord of AI: Profiting From Tech’s New Superpower.

I fully expect this little known firm to double… maybe triple in the next 12 months.

These three reports lay out the critical steps you MUST take today…

To profit from conquering the AI Kill Switch

And I want to make all of them available to you today… free of charge… the moment you agree to test drive my flagship letter, Katusa Resource Opportunities.

This is the foundation of my firm…

The publication where I share all my greatest investment insights… Month after month.

It’s in this publication I share all my findings of my global investigations to see where the major money is converging…

Where the biggest opportunities are emerging…

And how you can get in before institutions choke out all the profit.

Let me give you an idea of what you receive the moment you agree to join Katusa Resource Opportunities.

See, this is where I showcase the top investment ideas I find around the world.

Every year I am in the air – I’ve traveled to 100 countries. More than 1 million air miles.

That number climbs every week.

I sift through my Rolodex of millionaire and billionaire investors…

Guys with their fingers on the pulse of every major resource from gold, oil, to gas, and rare earth elements that power the modern world.

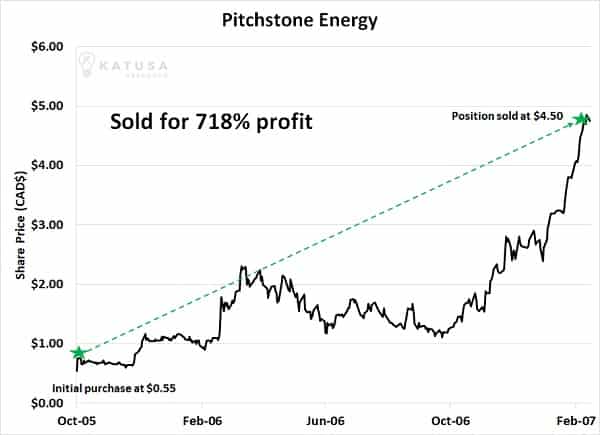

Like when I laid out my $1 million bet on lithium in January…

Or a few years ago, when an early insight put me into a uranium play… way before the rise of nuclear energy recently put it back on the map to power AI.

In short, I’ve never been an armchair investor.

When I tell my readers something is a buy – I’m out in the field, opening my own wallet and putting skin in the game.

I make it my business to know the key players involved.

It’s how I was able to pinpoint a company called Northern Dynasty – and nail a gain of 1,053% in 11 months.

And it’s through my contacts I discovered an obscure firm with headquarters in Ulaanbaatar, Mongolia called Prophecy Resources – which surged 4,160%.

Or when mining entrepreneur Paul Matsyek clued me in on a project called Lithium One… leading to a 2,440% gain…. After I politely declined an offer to become president of the company.

Here’s my point:

I don’t only sit behind a computer screen and run diagnostics or Bloomberg Terminal “studies” to find investments. Knowing the data is important, but one must go to the projects.

I go out there. I buy into these companies after I sit with the most elite executives in the world.

And I share those situations with my inner circle.

That’s what I do every single month with Katusa Resource Opportunities.

Again – it’s why we’ve nailed some life changing windfalls through my network of bankers, CEOs, and boots-on-the-ground experts in fields ranging from rare earths to oil to gold and silver.

Members of my network have enjoyed some incredible gains.

For example, a fellow named Frank F. wrote to say about my ideas:

Marin always finds investments I have never heard of, but I’ve learned to pay attention. He suggested buying Brazil Resources… I made exactly half a million dollars after getting back my original $90,000. I made over 500% in less than a year.”

Nick F, a dentist and accredited investor, said:

My portfolio has taken off completely. Marin has made a fantastic difference with my success in the resource sector.”

And Ron T., an accredited investor and former pilot, said:

Nobody out there understands what’s going on in the resource sector more than Marin does. Aside from his absolute knowledge of what’s going on, and his overall business acumen, his value to people like me as an investor cannot be overstated.”

And I love this one. Dave Z. wrote to say:

Marin,

I spoke to my family yesterday about how I felt about devoting most of my life to figuring out the energy space and how to play it and how I don’t need to do that because you gave us a huge shortcut by giving us access to the best ideas and companies in the stock market.

While I will continue to educate myself, I feel like we have a huge advantage. I just wanted to tell you I appreciate what you are doing for me; for the first time in my life my trading account is in the 7 figures, and you have a lot to do with that.

And all of this has led to today’s presentation…

Today, I’ve laid out the single biggest situation in the world – a situation which touches every aspect of society…

From resources…

To technology…

To geopolitics.

The rise of AI has created a pressure on the energy sector unlike any since the rise of the automobile…

And the opportunities are unparalleled.

Conservatively, my #1 nuclear energy investment has the potential to unleash a gain of 1,000% over the next 12 months.

And I consider that the floor – not the ceiling.

When combined with the potential lifetime of income from the next gen green energy company I outlined…

As well as the dominate positioning of the AI “Landlord” I shared…

I’ve laid out the perfect triple-crown win to play the AI revolution…

Without having the bet the farm on the next “breakthrough” tech firm.

Instead, we’re using all my research to get in on the investments which will make it possible for these AI engineers to progress.

It would be like trying to make a microchip without silica sand.

Like trying to build an EV battery without lithium.

It’s simply not possible.

That’s what the AI Kill Switch represents – it’s paramount to the success or failure of the entire revolution.

Otherwise data centers across America will cease to operate overnight.

ChatGPT will show ‘generating’ forever…

Text messages slow to a crawl…

Google stumbles through every search query.

You and I both know this won’t be allowed to happen.

Which is why I want to share my key investments with you today… outlined in my 3 reports:

1. The AI Energy Miracle: 1,000% Riding The Next Atomic Wave.

2. The Payday Protocol: A lifetime of income thanks to America’s Pipelines.

3. The Landlord of AI: Profiting From Tech’s New Superpower.

I want to send you all three of these reports the moment you start a trial of Katusa Resource Opportunities.

And I want to make it possible for you to join with the best offer I’ve ever made…

The cost of Katusa Resource Opportunities is $4,500 per year.

When you consider I’ve invested more than $100,000 into the algorithmic engine that operates – day and night – to review all my investments…

Cross referencing every data point… verifying every financial metric…

Or that I spend tens of thousands per year flying around the world to meet with billionaires like Ross Beaty and Eric Sprott… or investment legends like Rick Rule and Doug Casey…

You can see $4,500 is just a drop in the bucket.

$1,000 into my Lithium One play would have come back as $17,500.

$1,000 into my recommendation on Ryan Gold had the potential to pay a profit of $15,500..

$1,000 in my VMS Ventures investment would have yielded a $20,000 homerun.

And that’s just three of my winners.

There are dozens of triple and quadruple digit winners I’ve amassed over the years.

That said – I don’t want to charge you $4,500 today.

Or $3,500.

Or even $2,500.

Instead, because of the special circumstances around this offer…

I am cutting the cost for a 12 month membership to Katusa Resource Opportunities down to just $1,995 for the first 500 people who respond today.

But I’m going to do even better.

I want you to take the next 30 days to decide if this is for you.

In my line of work, results have always been the priority.

It’s why I’ve been part of more than $3 billion in financing deals…

Why I’ve been privileged to work shoulder to shoulder with some of the greatest investors in the world…

I’ve turned a humble teacher’s salary into more than $15 million…

And I’ve been offered seats on the boards of the most exciting resource companies on the planet – like Lithium One I mentioned earlier, before it jumped 2,400%.

I’ve built my name… my career… on prioritizing results.

And I believe my work here today – laying out the AI Kill Switch and the vast opportunities it has created for you…

I think this may be some of the most vital research I’ve ever shared.

Again – it will impact 300 million people across North America.

This is a fact.

We know AI’s energy consumption at these data centers, like the hot zone of Loudoun County, will only rise.

Failing to be in at the ground floor will be considered equivalent to missing the windfall of the decade – I fully believe that.

I don’t want that for you.

Which is why I’m slicing the price of Katusa Resource Opportunities to $1,995 today…

And I am giving you the next 30 days to decide if it’s for you.

Let me be clear:

Over the next 30 days, if you decide my research isn’t for you… just call my firm up and we’ll refund you every penny…

AND you can keep all the research I send you in the meantime – as a way of saying ‘thanks’ for giving me a fair shake.

So real quick… let me recap everything you get today as one of the 500 people who claim this limited offer to Katusa Resource Opportunities today.

Beginning immediately, you’ll receive:

The Monthly Issue – You’ll be sent an electronic issue of Katusa’s Resource Opportunities straight to your inbox.

Each issue evaluates my current open positions in the resource markets, future plays, and deep research behind the companies that my subscribers are investing in.

And I put millions of dollars of my own money on the line.

I can also say with 100% certainty the level of depth in these issues is unmatched. This is why Katusa’s Resource Opportunities is considered the premier natural resource newsletter in the game.

With your subscription, you’ll also receive:

Special Reports – These reports we publish periodically will give you all the details on specific sectors, so you can jump in on quick money-making opportunities.

Interim Alerts – Katusa Research subscribers are like alligators waiting in the trenches for the right money-making opportunities.

Sometimes you sit out and let other people foolishly lose their money…

And sometimes you have to strike fast for quick gains.

We send out regular alerts to take advantage of quick plays and secure the kinds of gains that others would take months—even years— for others.

Third, you get my three new reports:

- The AI Energy Miracle: 1,000% Riding The Next Atomic Wave…

- The Payday Protocol: A lifetime of income thanks to America’s Pipelines…

- The Landlord of AI: Profiting From Tech’s New Superpower.

Frankly, it would cost thousands anywhere for the level of research I’ve pulled together in these three documents.

But you get them free the moment you join Katusa Resource Opportunities.

Fourth, you get the entire KRO Library & Portfolio.

This is every open and current recommendation… as well as every research report I’ve published. I’m not going to mince words – this is the stuff hedge funds pay tens of thousands of dollars for. This is my entire portfolio of investments with price targets, sell targets, key players…

Fifth, you get access to the entire Katusa Resource Opportunities encrypted member’s only page.

This is every trade, every report, every alert, the entire portfolio, available for you at any time.

Sixth, you get a special rate of more than 50% of the retail price today by being among the first 500 to claim your spot.

And seventh, you have the next 30 days to decide if my work is for you – or you’re entitled to a complete 100% refund of every penny you pay for your membership today.

I can’t make it more compelling.

I’ve put every asset I have available to me into making Katusa Resource Opportunities the premier elite research service.

And my work has helped men and women from all walks of life make fortunes.

Just ask one of my readers, James W., who—right after he signed up— wrote to say:

“Already paid for itself in one week. Incredible!”

Or Aaron B., who said:

“Awesome service… most valuable investment dollars I spend.”

Ronald T. said:

“I quickly understood that Marin was perhaps the most intelligent person I was aware of doing work in this sector. I can’t think of anybody who has a better command of what’s going on, that is more concise with their knowledge and sharing that knowledge, so I am 100% aligned behind Marin in whatever he does.”

And Bill T. wrote to tell me:

“With over thirty-five years in the business, I have never seen anyone work so tough, so hard, so diligently and so capably for a guy under forty. Marin is an incredible, hardworking individual, he is relentless in his negotiating skills with companies, and he is a tremendous, loyal person to his subscribers.”

This is the caliber of research I am bringing to you today…

And I believe the AI Kill Switch we’ve gone over is the single most important topic I’ve ever covered.

You now have the exact avenues laid out to profit as this situation unfolds.

All you have to do is click the button below.

You’ll be taken to an encrypted page, where you can review everything I’ve laid out.

You’re not making any commitment by clicking the button below… but you’ll have a chance to review everything in plain English…

To make the best decision with all the facts in hand.

But understand – I have over 100,000 readers on my free daily e-letter.

And I am only accepting 500 people with the special offer today.

I don’t want you to come all this way empty handed.

So make sure you click the button below and secure your spot for the next 15 minutes before it’s snatched up.

Remember – you have the next 30 days to decide if Katusa Resource Opportunities is for you.

But you must click the button below right now.

My name is Marin Katusa.

Thank you for joining me today and viewing The AI Kill Switch. I’ll see you on the next page.

Marin Katusa

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Please click on PROCEED TO NEXT STEP button once and wait. Do not refresh the page.

REFUND POLICY:

Over the next 30 days, if you decide my research isn’t suitable for you, simply contact my firm and we’ll refund every penny. In short, you have a 30-day full money-back guarantee.

Note: All Prices are in USD.

AUTO-RENEWAL:

When you pay for Katusa’s Resource Opportunities with your credit card, you will be billed a membership fee of $1,995. If you wish to keep your membership after the first year, we will automatically bill you $1,995 on your one year anniversary. We will continue to bill you $1,995 after that.

You will receive at least one reminder before being billed your maintenance fee. This discounted membership price is locked in for the life of your membership. It will never rise. If at some point in the future you wish to discontinue your membership, email or phone us and your membership will stop.