A Porter & Co Subscriber VIP Invite to close by November 21st

GOING VERTICAL

Gold’s Breakout Moment:

How the Next Bull Market Could Transform Your Portfolio

● The Gold Price is showing signs of going PARABOLIC…

● The 5 Key Catalysts of the coming gold bull market and the real reason why the ultra-wealthy and many of the richest nations are silently buying gold.

● Two Gold Stocks – That Marin Katusa is betting MILLIONS of dollars on that could move 500-1000% in the next 12-24 months.

● PLUS: Buyout Targets – That could provide “overnight” windfalls of 50-150%

Act Today Before This Special Offer Expires

Dear Younger Me,

I’m writing to you from the future—where gold just crossed $3,000 per ounce, and you’re probably kicking yourself.

I need you to understand something: this was a major wealth-building opportunity, and you missed it.

You had all the signs in front of you.

The world was on fire, inflation was spiraling, central banks were hoarding gold, and geopolitical tensions were rising by the day.

You watched the headlines, but you didn’t act.

And now you’re sitting on the sidelines, watching as others reap significant returns—and it could have been you.

This Wasn’t Just a Rally—It Was a Major Bull Market

Let me remind you of what you were seeing: Gold had already crossed $2,500—breaking records and experiencing substantial growth.

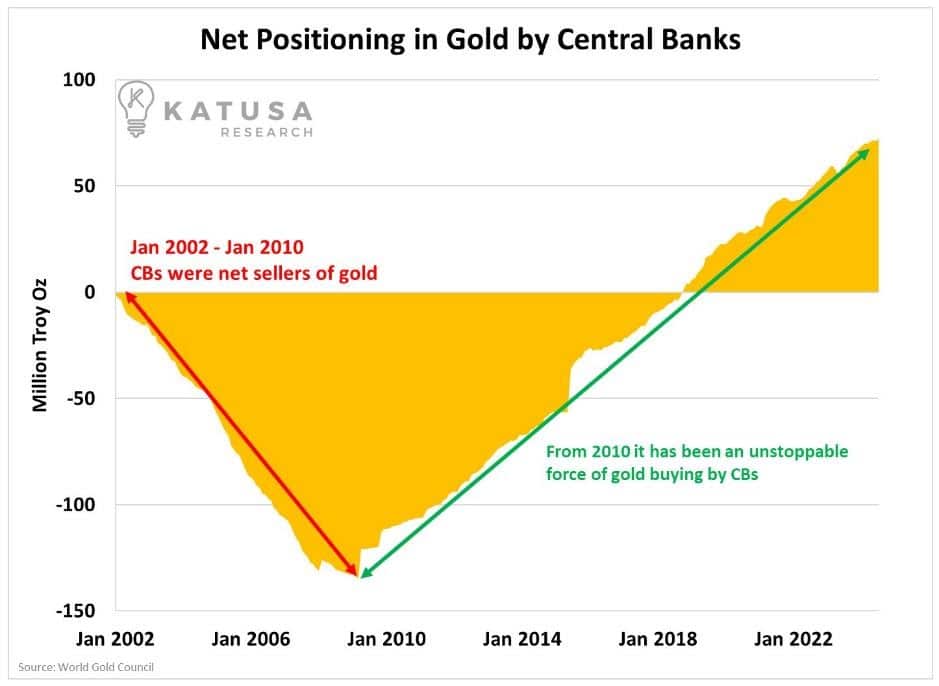

You read about central banks buying over 1,100 tonnes of gold in 2023, more than at any point in over 70 years.

Sincerely,

The You Who Missed the $3,000 Gold Bull Market

P.S. I’ve prepared the quick blueprint of all the material staring you right in the face. Right from legendary resource investor Marin Katusa, a friend I have watched make money for over 20 years in the gold sector, who repeatedly banged on the table on his best ideas. Read on…

Gold Catalyst #1: Central Banks Knew the Stakes – Did YOU?

Let me remind you of what you were seeing: Gold had already crossed $2,500—breaking records and skyrocketing like never before.

You read about central banks buying over 1,100 tonnes of gold in 2023, more than at any point in over 70 years.

Countries like Saudi Arabia were outed as secretly accumulating 160 tonnes of gold in one of the LARGEST PURCHASES of a central bank in 2024.

Central Banks see potential challenges ahead and they are preparing by holding hard assets like gold.

And you? You watched, hesitated, and told yourself, “I’ll wait a little longer.”

While you waited, the gold price started gaining attention from traders, inching closer to what could be its next breakout…

When the world faces uncertainty, gold doesn’t just rise—it can increase significantly. You thought you had more time. You thought the world would somehow stabilize.

But it didn’t.

100 Years in the Making… The Great Gold Bull Market Has Begun

Gold just shattered its all-time high and big investors are jumping in.

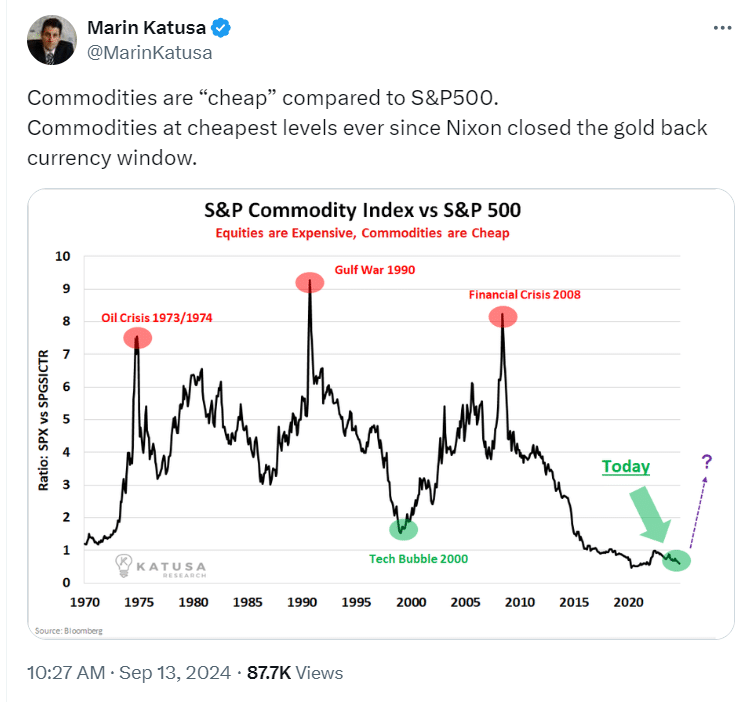

A commodity supercycle is underway, poised to unleash a “roaring 20s” economic revival.

When the gold price rises just $50-100 per ounce…

The right gold stocks don’t just climb; they can soar to blistering heights, offering gains that could eclipse the most speculative tech investment.

I’ve shown my subscribers select opportunities to make huge gains in gold stocks over the years—even in a so-called bear market.

This type of investing and speculation is NOT for everyone. In fact 99% of people can’t stomach the volatility. If that’s you, I suggest you stop reading right now.

But – I’ve made it my living and built a business to find extraordinary opportunities in the market, with high risk, and potential high return.

- In fact, back in 2015—the middle of the last gold bear market—I recommended Kirkland Lake at $3 a share.

It then went over $39 a share—a 13X gain…

Catalyst #2: A Gold Market Like NO OTHER

The price action right now in 2024 is pointing to a truly unprecedented gold bull market. And it’s the type of High-Risk / High-Reward setup that I absolutely love.

And we’re seeing a lot of excitement building in gold especially.

You see, my followers have scored many big returns over the last few years after publishing on fast moving opportunities across the resource sector…

- Like 201% profit in a gold producer.

- A 664% profit in a small cap gold company that picked up a top-tier asset.

- A 47% profit in one of the world’s top energy companies (and still paying us a handsome dividend).

And also 113% profits in a gold/copper development company.

Returns of course are not guaranteed.

And putting any money into the stock market is high risk, but some of our subscribers that did very well, wrote in to tell us…

As subscriber Kevin B. said …

“I got a little squeamish when this stock had tripled, and so I sold enough to cover my initial cost) and kept the rest. I think your communication timing is pretty good – and next time, I might wait a little longer before I lose my nerve and start to sell. As it is, I’m not complaining – but am very happy with my return on this stock. It paid for my subscription, and then some.”

And another subscriber, Tim S. said…

“I think the best part is that I am not an accredited investor yet (Marin) writes trading advice that applies to me also. As a result of Katusa Research I have significantly grown my retirement accounts and I feel it’s the BEST investment service I have ever used.”

Look – these are hand selected but real testimonials, not everyone will have the same results.

Just recently… we profiled a unique gold company that’s up over 51% since I published on it.

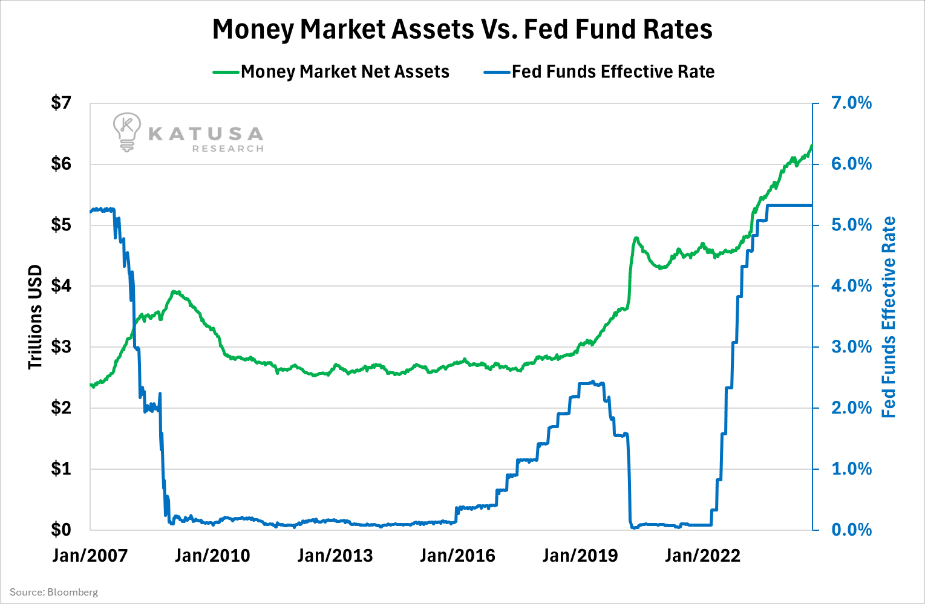

Catalyst #3: Over $6 Trillion in Cash on the Sidelines Looking for Opportunities

A September 50 basis point cut was no surprise.

But that means a big change in thinking and sentiment that will affect everyone, from the small traders to the US Government.

Over the past few years, the “T-Bill and chill” approach to cash management triggered assets under management of money market funds to soar to all-time highs.

However, this time around, because rates went above 5% it triggered a slew of investors attracted for yields at decade highs, not because of economic uncertainty.

And that money is looking for places to make returns…

You’re reading the chart correctly.

There is over $6 trillion sitting in money market funds, that are now going to start to see lower rates of return moving forward. For the first time in several years.

It’s no joke, I personally have a lot of my holdings in cash or near-cash funds that paid me just over 5% for nearly 2 years.

Those days are over.

Money will be looking for sectors where a small amount of capital can produce a massive return…

This capital is seeking opportunities for strong returns, and I’ll share a few sectors where I’m personally investing.

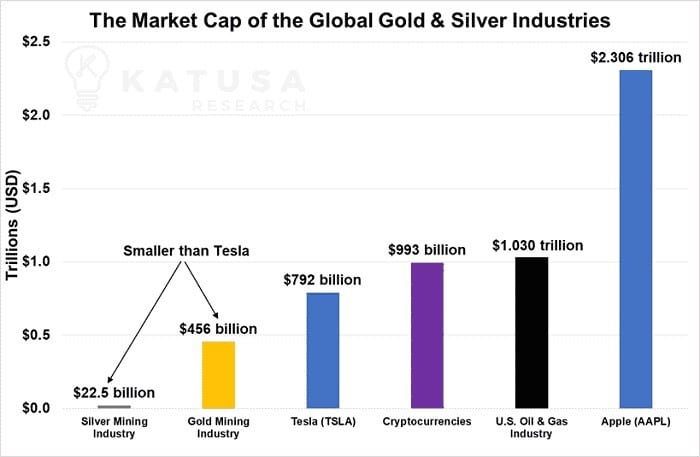

Catalyst #4: The Gold Sector is Tiny… A SMALL amount of Capital Could Send Stocks SOARING

In the investment world, even a wealthy individual with $200 million barely makes a ripple.

The real market movers are the “elephants”—massive pension, hedge, insurance, and sovereign wealth funds managing billions, even trillions.

Norway’s $1 trillion sovereign wealth fund, for instance, controls 5,000 times more than the richest investor.

These funds move markets, often in the same direction. But sometimes, they stray into smaller, less liquid assets like gold.

When they do, even a small portion of their capital can significantly impact markets, as the entire gold sector is smaller than giants like Facebook or Google.

Newmont, the world’s largest gold miner with a $60 billion market cap, is smaller than 266 S&P 500 companies.

If just 10 large fund managers each invested 1% of their portfolios into Newmont, they’d own 25% of the company, creating a buying tsunami in the gold market.

Gold Companies Could Rise 500-1000% From Today’s Levels… FAST

You want to be buying when no one else is paying attention.

And sell when everyone else is talking about it.

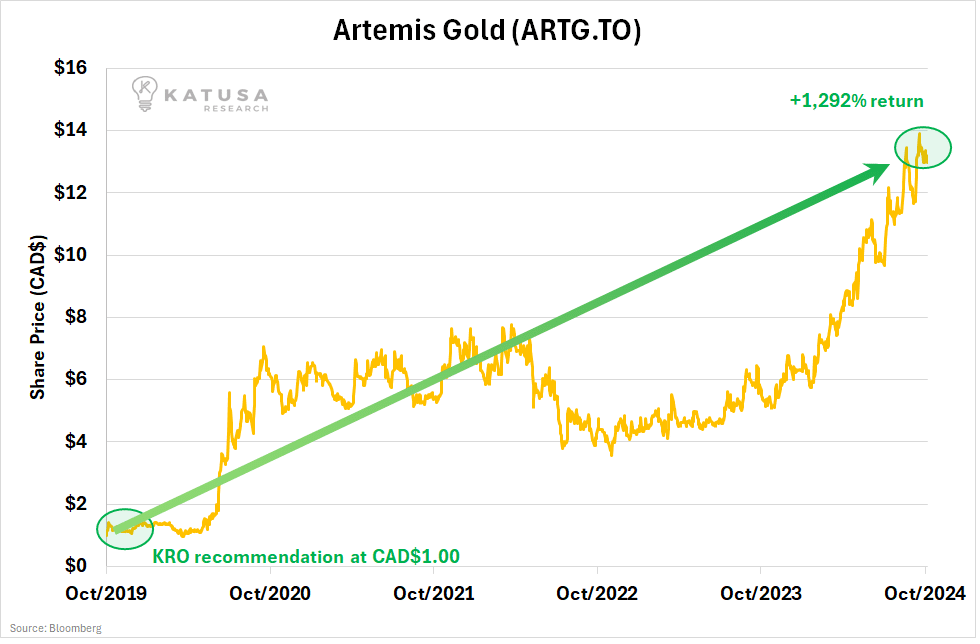

Case in point was when I alerted my readers to Artemis Gold.

Started by seasoned mining executive Steven Dean, it’s a fast-rising player in the gold sector.

Dean, with decades of experience in mining, launched Artemis with a clear vision: to focus on developing high-quality, low-cost gold projects in North America.

Their flagship project, the Blackwater Gold Mine in British Columbia, is one of Canada’s largest open-pit gold mines in development.

The Blackwater project stands out due to its potential for large-scale production and low all-in sustaining costs, which makes it attractive in a rising gold price environment.

The best part?

I published on the company when it was trading around $1 and a small market cap.

Here’s what happened next…

Artemis Gold recently touched $14 and provided those investors with a 1,300% win.

Note: Past performance does not guarantee future results. Artemis Gold is one of the best situations that can happen.

All it takes is one position like this to drastically change your portfolio and financial situation.

Now, I believe I’ve found the next two opportunities that could become Artemis Gold – or even bigger. Here’s why…

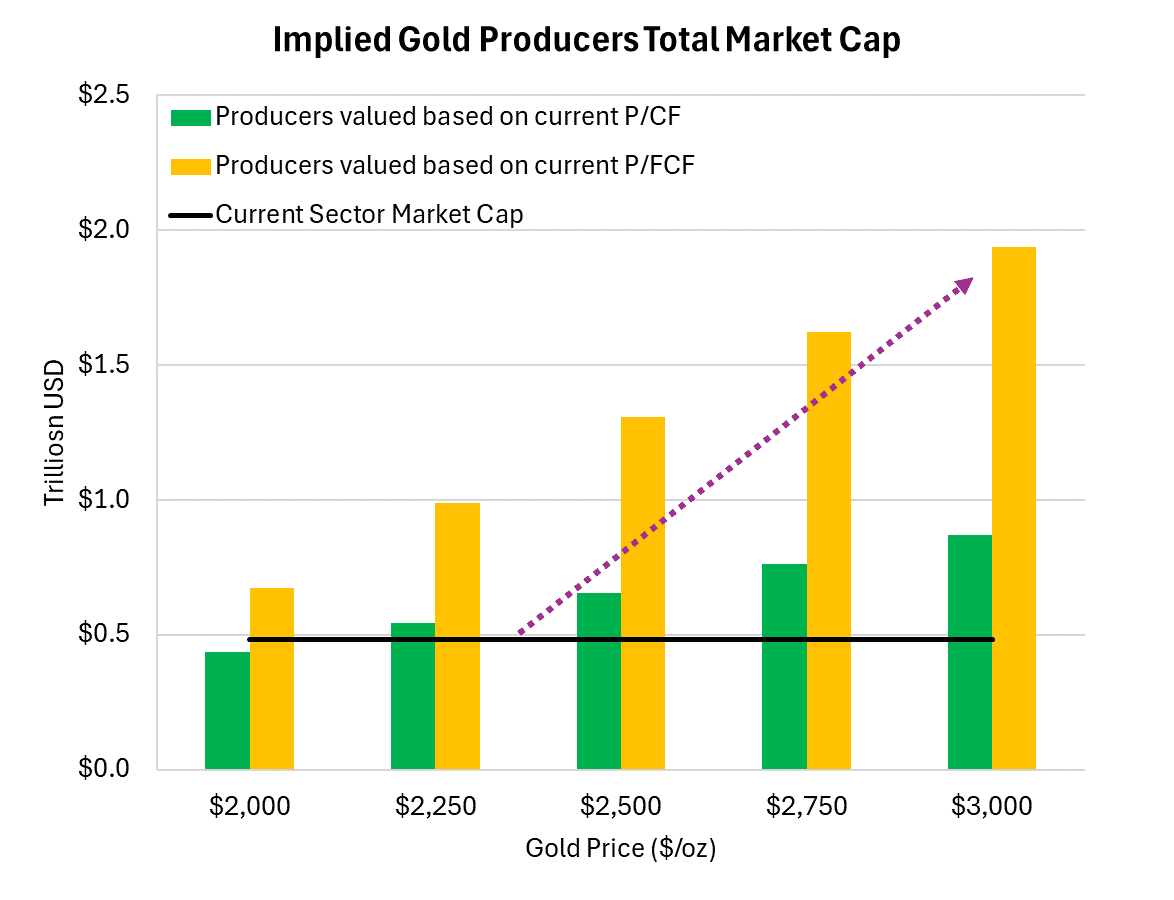

Catalyst #5: Gold Companies are at an Inflection Point… HIGHER

I’m going to show you a chart you’ve never seen before.

But company insiders and major funds are aware of this.

It’s the reason they’re quietly buying shares of the best gold companies – and my subscribers and I are too.

Here’s why…

In total, major gold-producing companies are worth under $500 billion. With gold at $2,500 per ounce, these companies could generate:

- $57 billion in cash flow (profits after operating expenses).

- $40 billion in free cash flow (cash flow minus capital expenses).

Right now, gold producers are valued at 11.4 times their cash flow and 33 times their free cash flow.

Applying these multiples to the expected $57 billion in cash flow would result in a market value of about $650 billion.

For free cash flow, this could jump to as much as $1.32 trillion.

Why This Matters:

There’s significant potential for growth, with these companies’ market value possibly increasing by $150 billion to $820 billion.

This creates an exciting investment opportunity!

- If gold prices rise and these companies earn more, investors could see substantial returns as the market adjusts their valuations upward.

And I’ve made SIGNIFICANT money in these types of markets. In fact, at this point in the cycle is truly one of the best times to place a bet.

So let me explain a little about who I am – and why I am bringing this to your attention today.

Which brings me to the unique situation today…

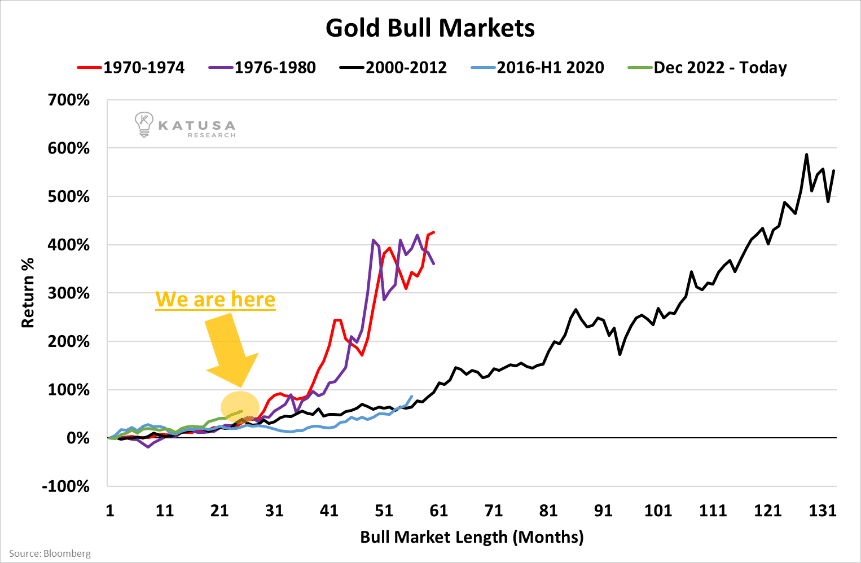

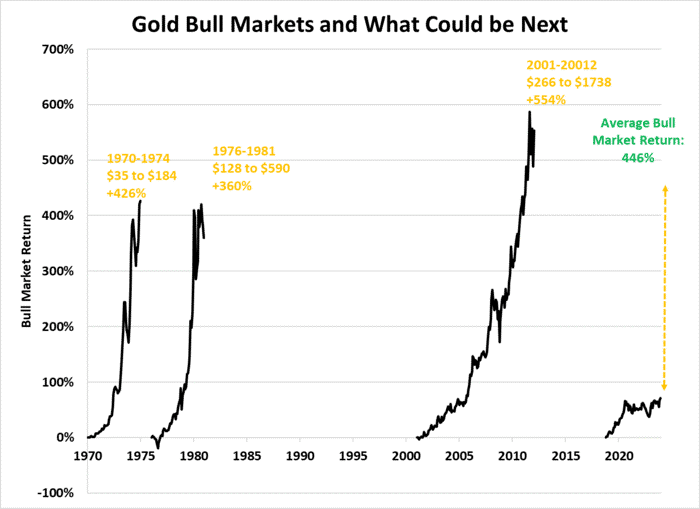

The gold market moves in cycles—from dramatic boom to overnight bust, and eventually back again.

So far in this “boom,” gold has barely risen 25% from its floor.

That’s not even close to the minimum required to qualify for a true “bull market” over the past century.

The smallest gold run-up in the past 90 years was 45 percent—more than twice the current gain.

Every other rally was far, far bigger:

- From 1972–1974, the rally yielded a 100 percent gain.

- From 1978–1980, another 100 percent gain.

- Then from 2007–2010, a 67 percent increase in the price of gold.

As you can see from the chart, when gold is ready to rise, it takes off.

Every single one of the years in the date ranges above saw an increase of more than 20 percent.

That’s how you know the 2024 gold rally has barely just begun.

It’s not unusual to see stocks that have already rocketed higher in our portfolio go up by many multiples.

But when I find a great opportunity, I don’t just run into the market and buy at any price. Instead, I stay patient and wait for great prices.

I “stalk” the stock. I wait for the market to mark it down. If it takes me weeks or months to accumulate what I want at the price I want, so be it.

That’s just how the resource market works.

This is how I’ve operated in the market for years and years… and how I’ve built a fortune in sideways and bear markets.

And I’m going to reveal my entire gold portfolio to you and show you how you can…

There are TWO MAJOR opportunities set to MOVE worth considering RIGHT NOW

Hi, I’m Marin Katusa, and after 15 years in the resource sector, I’ve seen it all.

From the dirtiest, most dangerous mines in the world to the hidden gems that turn a few dollars into a fortune.

And when I heard about this one “Ghost Mine”, I knew I had found something truly extraordinary.

When the price of gold goes up just a little… the right gold stocks can potentially go up thousands of percent.

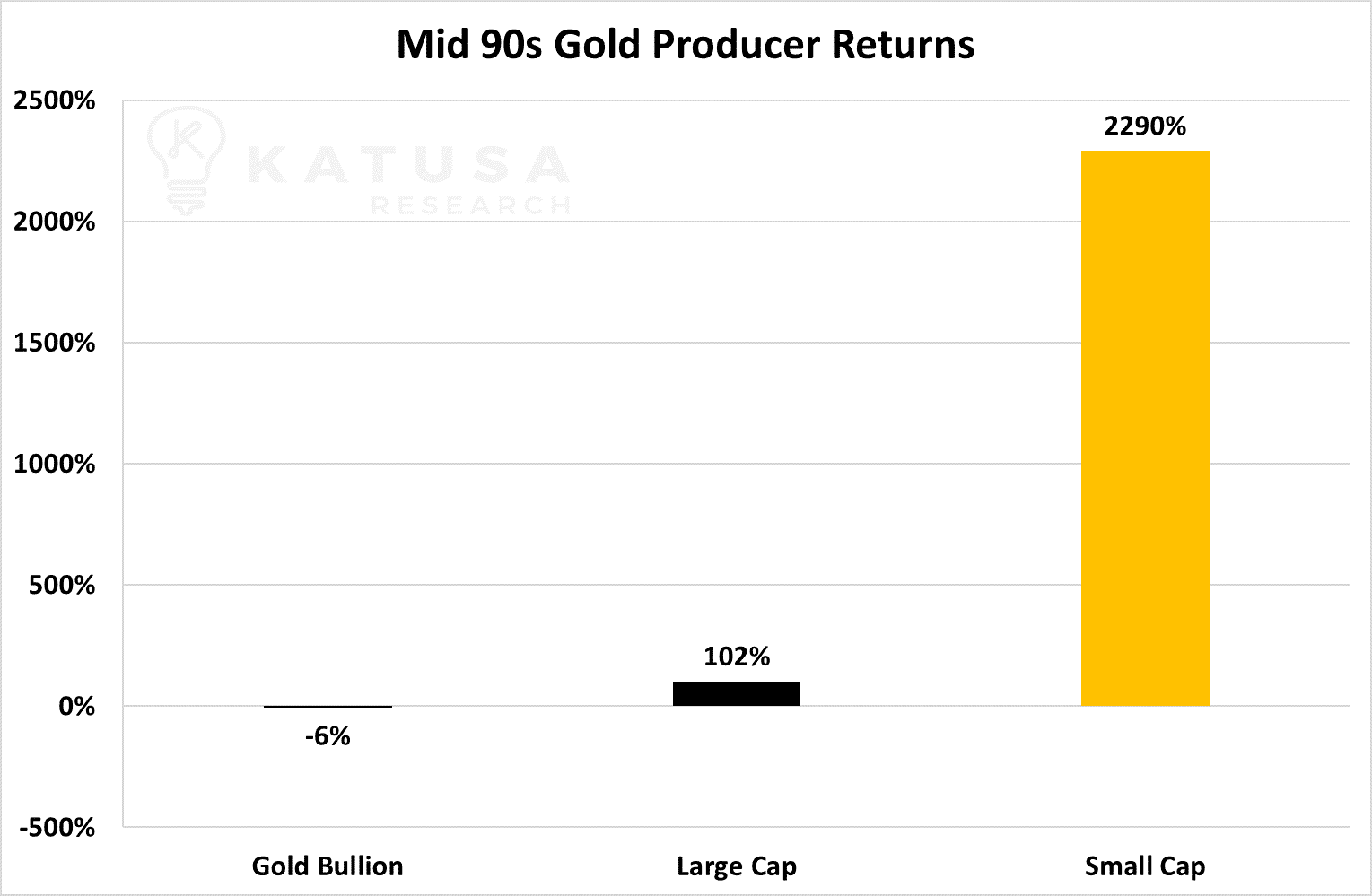

Here’s what happened in the 1990’s gold bull market…

I’ve seen these cycles repeat many times. And have looked to add a digit to my net worth each time.

Because I’m one of the world’s leading financiers in the resource space, I’ve shown my subscribers huge gains in little-known gold stocks over the years—even in a so-called bear market.

In fact, back in 2015—the middle of that gold bear market—I recommended New Market Gold (which then merged with Kirkland Lake at $3 a share). It soared to $75 per share.

Another of my recommendations, Ryan Gold, returned 1,450%.

And Midas Gold skyrocketed by 1,901%.

FULL DISCLAIMER and WARNING: These stocks are very high risk, and you could lose anything that you invest in the market. But that’s actually why I love the resource sector.

The fact is…

When you buy the right gold stocks at the start of a big bull market—like where we are right now…

It’s one of the only realistic ways you can potentially turn a small stake into enough to buy a vacation home… travel around the world… or secure your retirement for a long time to come.

Just don’t wait to decide if you can stomach the high risk and volatility, before your get in…

Because I believe that the next gold and natural resources bull market in gold is in the extremely early stages, right now.

URGENT GOLD STOCK #1:

The Richest 100 Square Miles on Earth: An Opportunity Worth Your Immediate Attention

Abandoned tunnels. Rusting equipment.

Ghost towns where thriving communities once lived.

This stretch of land, once called the richest 100 square miles on Earth, was declared dead decades ago. But something’s changed.

This land was once home to one of the largest gold mines in history, producing over 40 million ounces of gold.

But by the early 2000s, with gold prices barely above $300 per ounce, mining operations slowed to a crawl.

It wasn’t worth digging out the harder-to-reach deposits. The mine was abandoned, and the surrounding towns became ghost towns.

Fast forward to today, and everything has changed. Gold is worth 10x more now, and one man—a legend in the industry—is bringing this mine back to life.

Enter “Doctor Q.”: The Surgical Gold Miner

If you’re in the resource world, you know Dr “Q.”. He’s not just any gold producer. He’s the guy who turns forgotten projects into billion-dollar opportunities. His last company was acquired for $3.5 billion, after delivering gains of 3,900%… 1,608%… and 9,536% to early investors.

Dr. Q. had retired, but when he saw what was left in the Ghost Mine, he couldn’t stay away.

This isn’t just a rich deposit—this is a gold mine 500% richer than the average.

Early tests show up to 6 grams of gold per ton of rock, compared to the global average of 1 gram per ton.

To put it simply, this mine is five times richer than most working gold mines today.

So how did such a rich deposit sit under the radar for 20 years? Timing. When gold prices collapsed, mining companies stopped going after the harder-to-reach deposits.

But with prices now soaring, it’s a different game.

This is sitting right in the heart of America—right under the noses of experienced miners—and it’s about to make some early investors very wealthy.

I’ve known “Doctor Q.” for years and invested (and made millions of dollars with him). It’s safe to say, I trust his instincts.

If he’s coming out of retirement for this, it’s because the opportunity is too big to pass up. And from what I’ve seen, this could be his biggest discovery yet.

This is a chance to get in on the ground floor of a project that could deliver massive returns—just like his past successes.

URGENT GOLD STOCK #2:

The Best Kept Secret in Gold is About to Erupt: Your Shot at a Multi-Billion Dollar Opportunity

There’s a gold project quietly sitting on a deposit already defined with 5.3 million ounces with over 2.7 million feet of drilling and it’s believed to be multiple times the size of its current known deposit—and almost no one is talking about it.

The reason? It’s been buried under layers of permitting bureaucracy for years.

But that’s all about to change, and fast.

In the heart of Canada, a once-forgotten gold rush mine is set to be revived. This project has the potential to become a half-million-ounce-per-year producer, with one of the richest deposits in North America.

Right now, it’s trading at a fraction of its future value—but that window is closing.

The man behind this gold play is no ordinary CEO. We’ll call him The Gold Architect.

He’s the kind of leader that turns overlooked projects into billion-dollar winners. And his last venture sold for $3.5 billion.

He’s built multi-billion-dollar companies before, and now he’s back, laser-focused on what could be his most significant project yet.

Unlike many gold explorers chasing dreams, The Gold Architect has his hands on a fully drilled, near-production project.

The company has over 2.7 million feet of drilling (about the distance between Los Angeles and San Francisco) done at a cost of over $700 million.

And more than enough to show 5x richer grades than the average gold mine.

How rich? The current average mine yields about 1 gram per ton of rock.

But this site? It’s expected to produce at over 3 grams per ton, and the Gold Architect believes he can increase the grade by reducing the non-gold material by using a proven technology called an ‘Ore Sorter’.

This unique method separates the gold from the waste at the source, increasing the grade of the material going to the mill to be processed at over 6 grams per ton. In mining terms, that’s hitting the jackpot.

The stock could get hot, fast, because..

Final permits are just weeks away.

Once that happens, this project will no longer be flying under the radar.

It will have the attention of every major research outlet and investment bank.

Investors who move now are looking at the potential for 5-10x returns, as this stock is trading at just a fraction of its net asset value.

But that’s not all. This company already has the infrastructure in place.

Even the CEO himself is putting every dollar of his investable wealth into this venture. So is the President of the company.

I’ve spent time on the ground, gone underground into the mine, spoken with geologists, and personally analyzed the numbers.

That’s why I’ve bought over $1 million in stock at current prices, and invested millions into the company over the last 36 months.

This isn’t speculation—it’s a calculated move on a multi-billion-dollar opportunity.

The math is simple: once permits are secured, this company will re-rate dramatically. With gold holding above $2,500 per ounce, we’re standing at the edge of a massive revaluation.

The stock is incredibly undervalued now, but that might not last long.

When the world finds out what’s about to happen, the re-rating could be fast and furious.

You’ll get the full details, analysis and first hand reports on these two stocks (I’ve personally been to their projects) in my new special report: UNLOCKING GOLD JACKPOTS HIDDEN IN PLAIN SIGHT: America’s Best Kept Gold Secrets.

Now…

There are just a few things you should know about my service before you take advantage of this special limited-time offer.

To make truly big returns in the resource market…

You must be willing to seize opportunities outside the comfort zone of most investors.

Grabbing the opportunity to make hundreds of percent often requires taking a risk…

…which often means buying stocks with small market caps… the kind you’ll never see in the mainstream news, or mentioned by a financial advisor. Because they involve HIGH RISK.

Yes, these stocks can be volatile. And not every opportunity will be a winner.

But that’s also why the gains I’ve shown readers in the past can be so hugely rewarding…

%

Africa Oil

%

Challenger Deep Capital

%

Caudrilla

%

ShaMaran Petroleum

%

Aben Resources

%

Energulf Resources

%

Sterling Resources

%

GNG Resources

%

Realm International

%

Stream Oil and Gas

%

Copper Mountain Mining

%

Hathor Exploration

%

Ryan Gold

In short…

If you’re willing to learn a new way of making money… if you’re willing to venture outside the conventional world of regular stocks and bonds…

You’ll be able to act on many of my recommendations immediately.

Others will be “watch list” stocks, where you need to be patient like an alligator.

I do this because the exact price you pay is so important on small stocks like these.

It can be the difference between a huge winner… or ending up on the wrong side of the trade.

Finally, you should have at least $15,000 in capital.

It’s none of my business how much you invest in my recommendations. But people who are equipped to use this service typically have accumulated capital and experience with which to speculate.

By now, you may be wondering… how much to get in?

How to Get Access Immediately – At a Special Porter & Co Deal…

Consider this…

Top hedge funds happily pay $50,000 for “deep dive” research projects on stocks that can return hundreds, even thousands of percent.

Also consider that in the past, people have paid $25,000 annually for access to my ideas.

But through this special five-day-only offer for readers like you, we’re not charging anywhere near that much.

For a small fraction of what people have paid in the past for my ideas… and the kind of gains I’m confident this research will deliver, you’ll get full access to my best gold and natural resource recommendations for the next 12 months.

One full year of Katusa’s Resource Opportunities normally costs $3,500.

It’s not cheap, for two reasons:

One: This research is extremely expensive to produce. As you’ll see, what I do is far beyond what you see from other research firms.

I spend over $100,000 per year on data services alone. I travel constantly – I have even booked private planes to get to sites during COVID. When I need specialized insight on projects, I pay expensive experts who are the top in the world in their specific fields.

All of this produces a much, much higher quality research product than you’ll find anywhere else.

Two: Because I focus on a very small sector, the high price tag ensures tons of people aren’t competing for shares. This allows me to provide tremendous value to serious folks who want to take part in what I’m doing.

My goal is to share this kind of investing with anyone interested in changing their lives for the better.

However, I don’t want to attract people with zero investment experience, discipline, or skill.

This simply isn’t for them. There are many newsletters and investment advisors that will gladly take your money, but I’m not one of them.

Katusa’s Resource Opportunities is for investors with some level of experience in the market… for people who know the value of a great idea.

After all, in the hands of the right investor, this kind of information could be worth a fortune.

For example, subscriber F.F. told me he made half a million dollars on just one of my recommendations:

“Marin always finds investments I have never heard of, but I’ve learned to pay attention. He suggested buying Brazil Resources. I bought 200,000 shares at C$0.45. It was a C$90,000 investment. I sold my shares at C$2.95. I made exactly half a million dollars after getting back my original $90,000. I made over 500% in less than a year.”

Today, because I want to make it as attractive as possible for you to access my top resource stock buys right now…

You can try one full year of Katusa’s Resource Opportunities for just $1,749 — that’s HALF off the regular retail price.

Only for Porter & Co readers for a LIMITED WINDOW ONLY.

Like I said, we rarely ever make a generous offer like this one…

So if you’re interested in joining, act now.

There’s a good chance you’ll never see the price this low again.

Immediately after joining, you’ll receive:

- One year (12 months) of Katusa’s Resource Opportunities. My “personal journal” of what I’m doing with my own money, where I detail the best small opportunities in the natural resource space.

You’ll see a full table of:

- ALL my current gold positions (PLUS 2 other IMMEDIATE BUYS RIGHT NOW all detailed for you),

- My average costs and

- Full analysis in the archives.

You’ll receive a new issue on the first Wednesday of every month. Right now, my recommended portfolio has several exciting opportunities you can get into right away… to potentially make 2x… 3x… 5x your money… or more.

With your subscription, you’ll also receive instant access to my complete archive of special reports, along with my recommended portfolio in Katusa’s Resource Opportunities, which shows you my top recommendations right now.

Plus: When you take advantage of this special offer today…

I’ll send you my just-published special report on two of my “top buy” opportunities right now…

Join Today and Get Your Special BONUS Report: The Buyout Frenzy Begins

As if the two urgent gold stock plays weren’t enough, we’re giving you even more value with our exclusive BONUS Buyout Report.

Inside, you’ll uncover two under-the-radar buyout targets that could potentially deliver immediate upside.

companies control world-class assets, and industry insiders believe they’re prime acquisition targets.

BUYOUT STOCK #1

Copper’s Hidden Giant: The Andes Explorer

Nestled in a prime South American copper belt, this company holds a significant project that has delivered some jaw-dropping drill results—up to 23% copper equivalent over 20 meters.

These results hint at the potential for one of the largest copper-gold discoveries in recent years.

only 17,000 meters drilled so far and backed by an experienced team known for billion-dollar finds, this explorer is poised for big things. Keep an eye on this one as further drilling could unlock even greater value.

BUYOUT STOCK #2

The Comeback Story: Northern Gold Revival

This Canadian company is sitting on a once world-class gold mine that produced millions of ounces at incredibly high grades.

With 3.3 million ounces of proven and probable gold and plans to restart production by 2027, the groundwork is set for a major resurgence.

Strategically located in a rich mining region, this project could quickly attract attention once the final permits are secured, making it a prime target for acquisition.

You’ll get all this in your FREE BONUS report:

THE BUYOUT FRENZY BEGINS: Why Major Miners are Gearing Up for These High-Value Acquisitions.

This Special Offer is Closing…

Bottom line: You can keep investing the way you always have, or you can join me in exploring some of the world’s most promising investments, ahead of the curve.

As the many letters and e-mails we receive from those happy subscribers can attest, joining Katusa’s Resource Opportunities could be the best decision you make this year:

Joel N.

Todd G.

Dillon F.

Cindy A.

John F.

James W.

To get started, click the “PROCEED TO NEXT STEP” button below.

This will take you to a safe, secure site where you can review everything before you order.

Regards,

Marin Katusa

Katusa’s Resource Opportunities

Take Advantage of Our Special Offer: $1,751 Discount Today

One year of Katusa’s Resource Opportunities normally costs $3,500.

But through this special limited-time offer, you can receive this research for a full 50% off the regular price—just $1,749.

Join today and you’ll receive:

One year (12 months) of Katusa’s Resource Opportunities. Expect a new issue on the first Wednesday of every month, featuring a big new opportunity in junior natural resource stocks from Marin—including his two favorite ways to invest in gold now for maximum gains.

- SPECIAL REPORT #1: UNLOCKING GOLD JACKPOTS HIDDEN IN PLAIN SIGHT: Two of America’s Best Kept Gold Secrets (a $3500 value)

- BONUS REPORT #2: THE BUYOUT FRENZY BEGINS: Why Major Miners are Gearing Up for These High-Value Acquisitions (a $2000 value)

- BONUS E-BOOK: The Secrets of Making Money in Gold & Gold Stocks ($150 value—yours free)

You’ll also get urgent email alerts as needed, when Marin spots an opportunity to buy or sell an investment that simply can’t wait days or weeks.

Refund Policy:

If you’re not totally satisfied with our report on this incredible opportunity and our extensive educational materials, simply let us know within the first 30 days of purchase and we’ll refund your membership fee, in full.

Auto-Renewal:

When you pay for Katusa’s Resource Opportunities with your credit card, you will be billed a membership fee of $1,749. If you wish to keep your membership after the first year, we will automatically bill you $1,749 on your one-year anniversary. We will continue to bill you $1,749 after that. You can cancel your subscription at any time before your renewal.

You will receive at least one reminder before being billed for your annual renewal. This discounted membership price is locked in for the life of your membership. It will never rise. If at some point in the future, you wish to discontinue your membership, you can email us here or phone us at 778-737-7381 between 8AM to 4PM PST (Monday-Friday) and your membership will stop.

Note: All prices are in USD.

To read our Terms and Conditions disclaimers, click here.

“The first recommendation I put money into (Northern Dynasty) made me $5,200 in the first month and paid for my annual subscription a couple of times over. It’s all upside from here. Thank you, Marin!”

-Bryan M.

“My portfolio has taken off completely. Marin has made a fantastic difference with my success in the resource sector.”

–Nick F.

“Marin, thank you for recommending Challenger Deep as I’ve never made 1000% returns before. I made out with about $25,000 on my initial $2500 investment then bought my first ever tailored suit. I feel like you should charge way more for finding these gems (but please don’t)!”

-Ante S.

“I just wanted to tell you I appreciate what you are doing for me; for the first time in my life my trading account is in the 7 figures, and you have a lot to do with that.”

-Dave Z.

“Marin always finds investments I have never heard of, but I’ve learned to pay attention. He suggested buying Brazil Resources… I made exactly half a million dollars after getting back my original $90,000. I made over 500% in less than a year.”

-Frank F.